What is the BULK Trading App?

The BULK trading app is a decentralized perpetual exchange built on Solana, designed to deliver institutional-grade trading performance without sacrificing the core principles of decentralization. While Solana already dominates spot DEX volume, perpetuals trading has remained constrained by the limitations of running professional orderbooks on a general-purpose blockchain.

BULK is closing this gap through a specialized execution layer that integrates directly into Solana’s validator network so that high-frequency and low-latency trading that only existed in centralized exchanges can now work natively onchain.

BULK’s Validator-Integrated Trading Architecture

At the core of the BULK trading app is a custom validator client called BULK-Agave, a fork of the Jito-Agave client. Validators running this client also operate BULK-Tile, a component that hosts the matching engine and processes orders asynchronously. Instead of routing trades through Solana’s standard transaction queue, orders are handled directly within this validator-integrated execution layer. This is how BULK bypasses network congestion and delays. Trades are matched in real time within the BULK network, while final settlement still occurs on Solana every block.

BULK shares a portion of its trading fees with validators running the BULK-Agave client. It increases the validators’ revenue and staking yields across the Solana network. This Better trading activity from BULK means a strengthening of Solana’s economic security, while Solana’s validator set directly secures BULK’s execution layer.

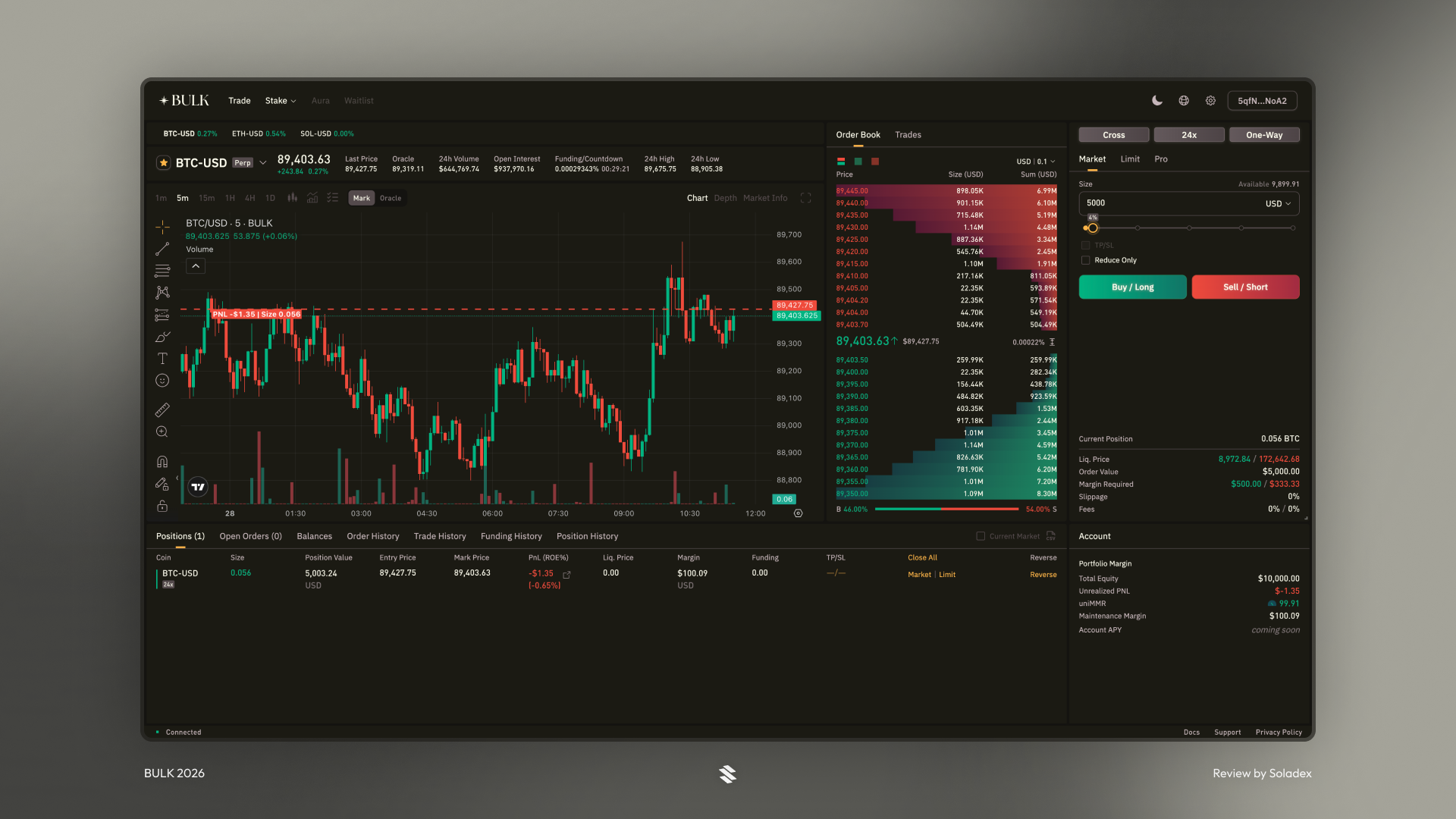

BULK provides a full-featured trading interface with detailed market data, funding history, orderbook depth, and real-time position tracking. In this section, we tried out the testnet and BULK fulfils what it promised users.

The BULK trading app is entirely SPL-native. User funds remain on Solana at all times and are held in non-custodial, user-specific program-derived accounts. There are no bridges, external chains, or centralized sequencers involved in the trading process.

In the examples below, we used BULK to show a few of the features that exist on the testnet.

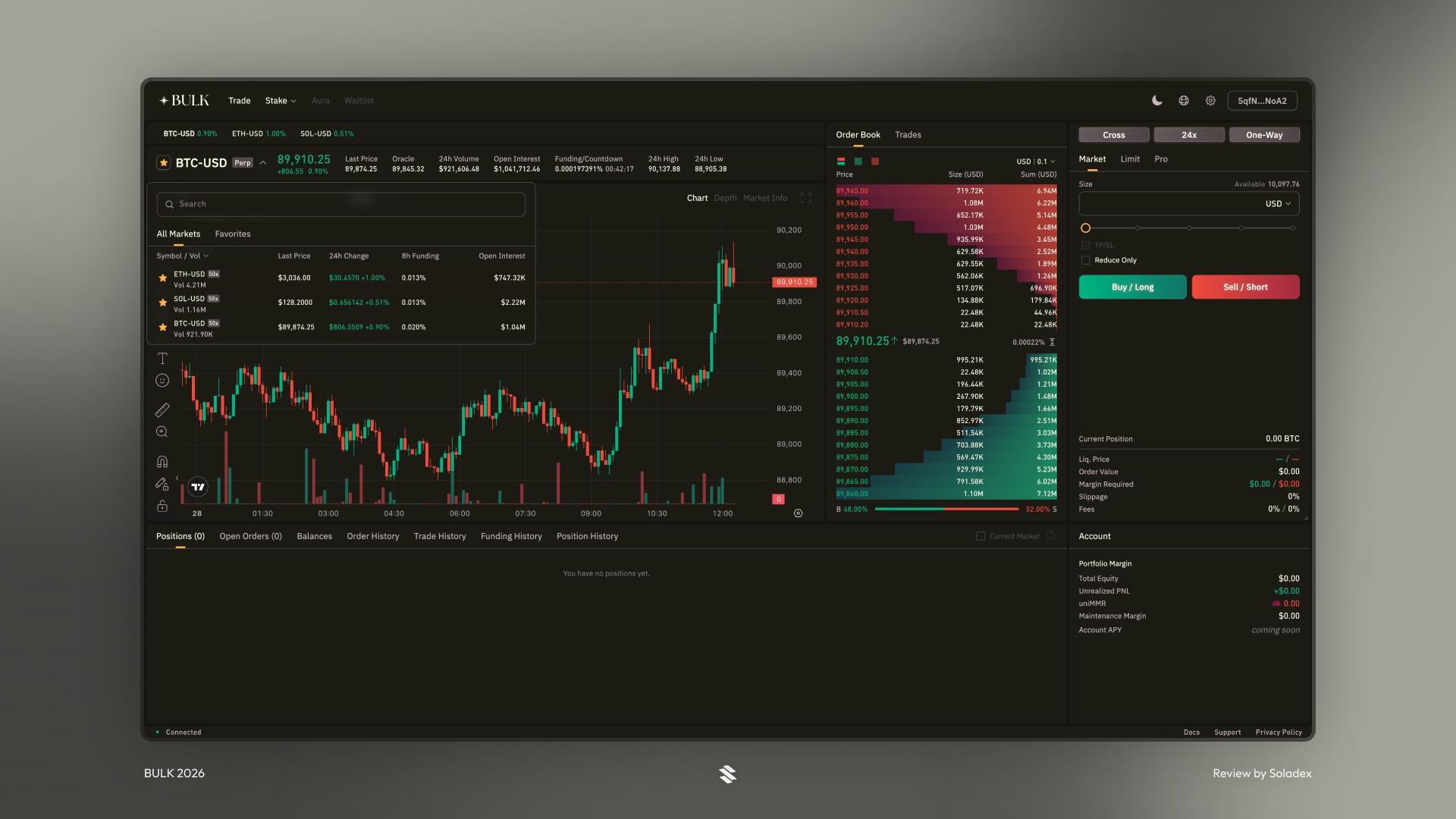

Perpetuals Market

Clicking on the BTC-USD pair drops down the list of all tokens that can be traded on BULK. Currently, BULK supports ETH, SOL, and BTC with a 50x leverage on each asset.

Position History

This is the most informative section for all past actions where trading details are logged. For all trades executed, BULK keeps a record of the time it was opened and closed, the entry price, the close price (average), and the maximum open interest on the trade.

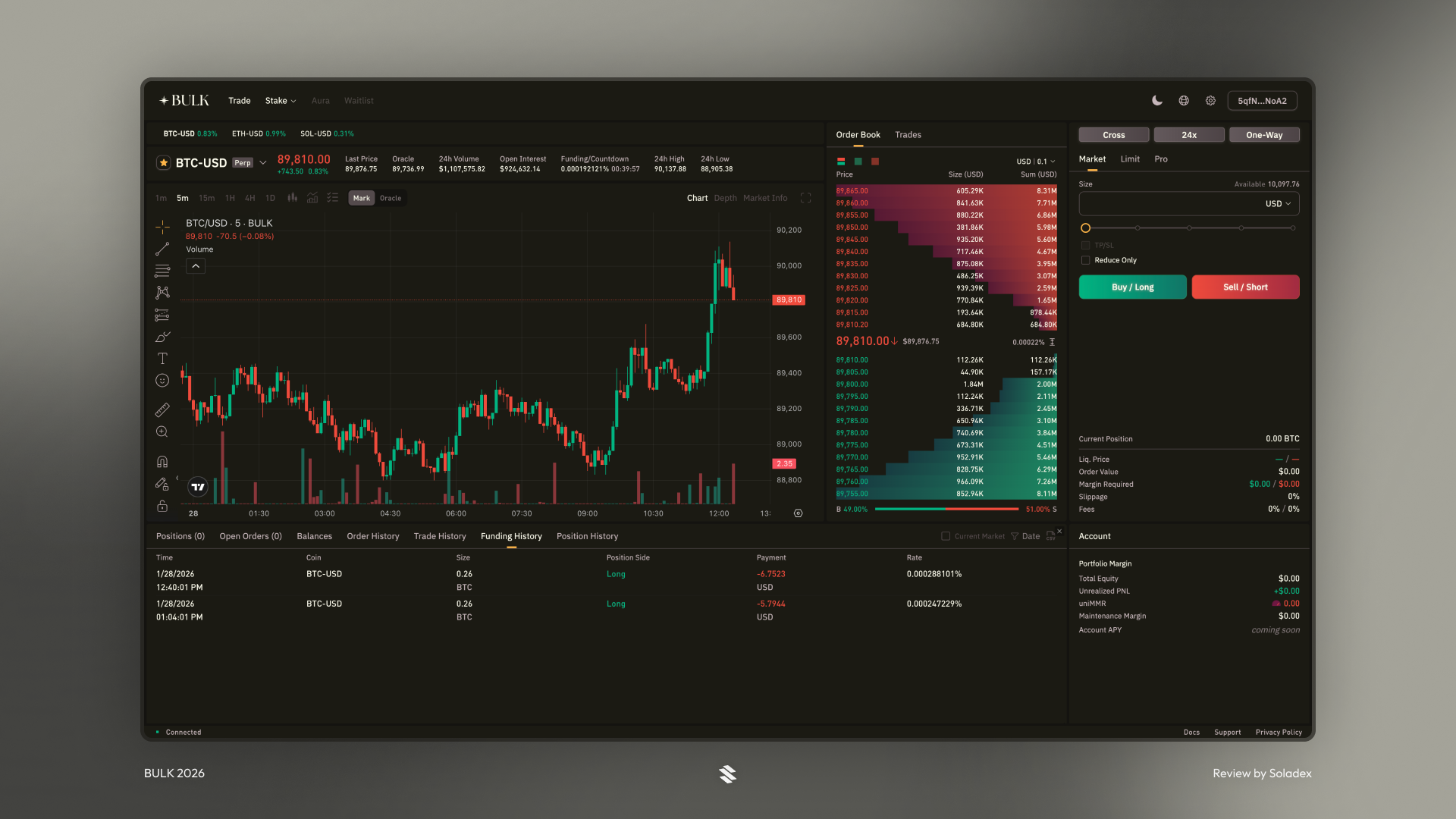

Funding History

The Funding History section in the BULK trading app provides traders with a clear, time-stamped record of all funding rate payments across their open and closed positions. It shows how often funding was paid or received and the exact rates applied.

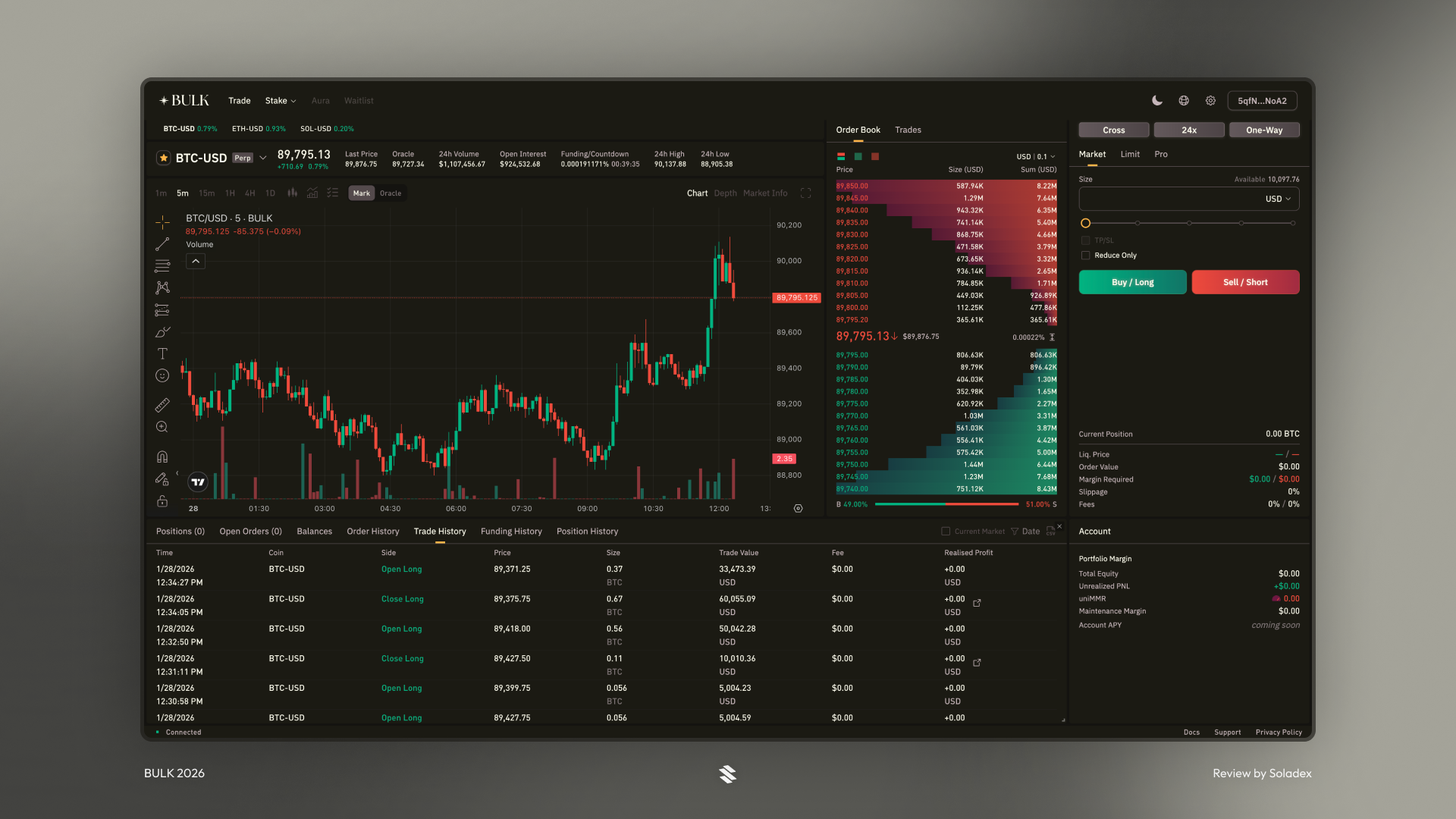

Trade History

BULK’s interface also includes the history of trades executed through the application. Details such as the exact time the trade was opened, the coin involved and the value of the trade are included in the trading history section.

Conclusion

The BULK trading app is a new approach to how decentralized perpetuals exchanges can be built. Instead of forcing professional trading into the constraints of a general-purpose blockchain, BULK extends Solana with a specialized execution layer that includes speed, fairness, and capital efficiency without compromising decentralization.