DeFiTuna is a Solana-based DeFi platform that brings together trading, lending and liquidity provisioning into one application. It allows users to provide liquidity in specific price ranges, borrow assets for leverage, trade with onchain limit orders, and access its efficient capital strategies.

How Does DefiTuna Work?

When you trade on DefiTuna, you interact with the spot market (limit and market orders). Liquidity comes from LPs who deposit tokens into pools; those pools execute trades and earn fees. Lenders supply assets to back the LPs’ leverage to help deepen markets and increase yield for lenders.

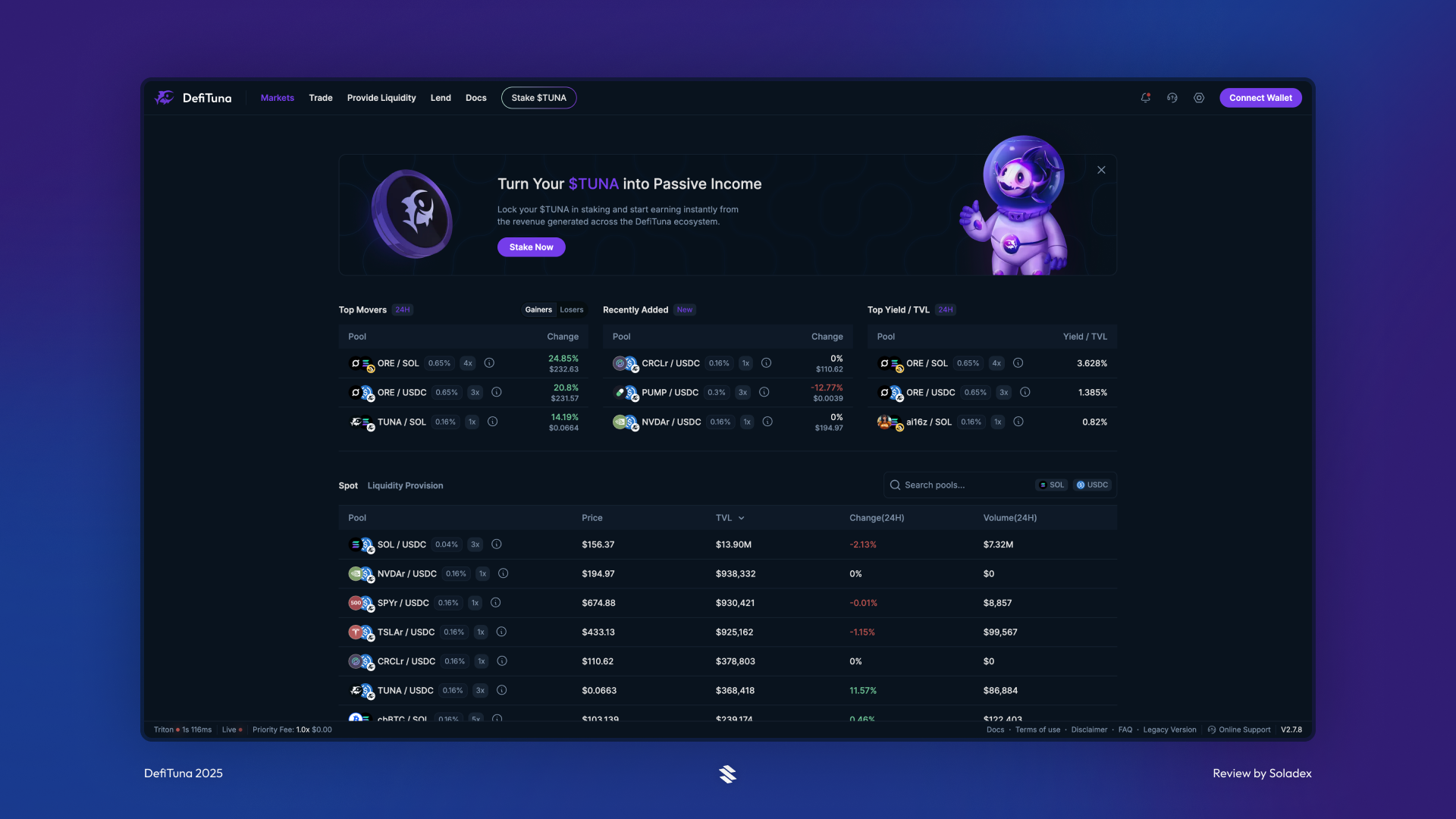

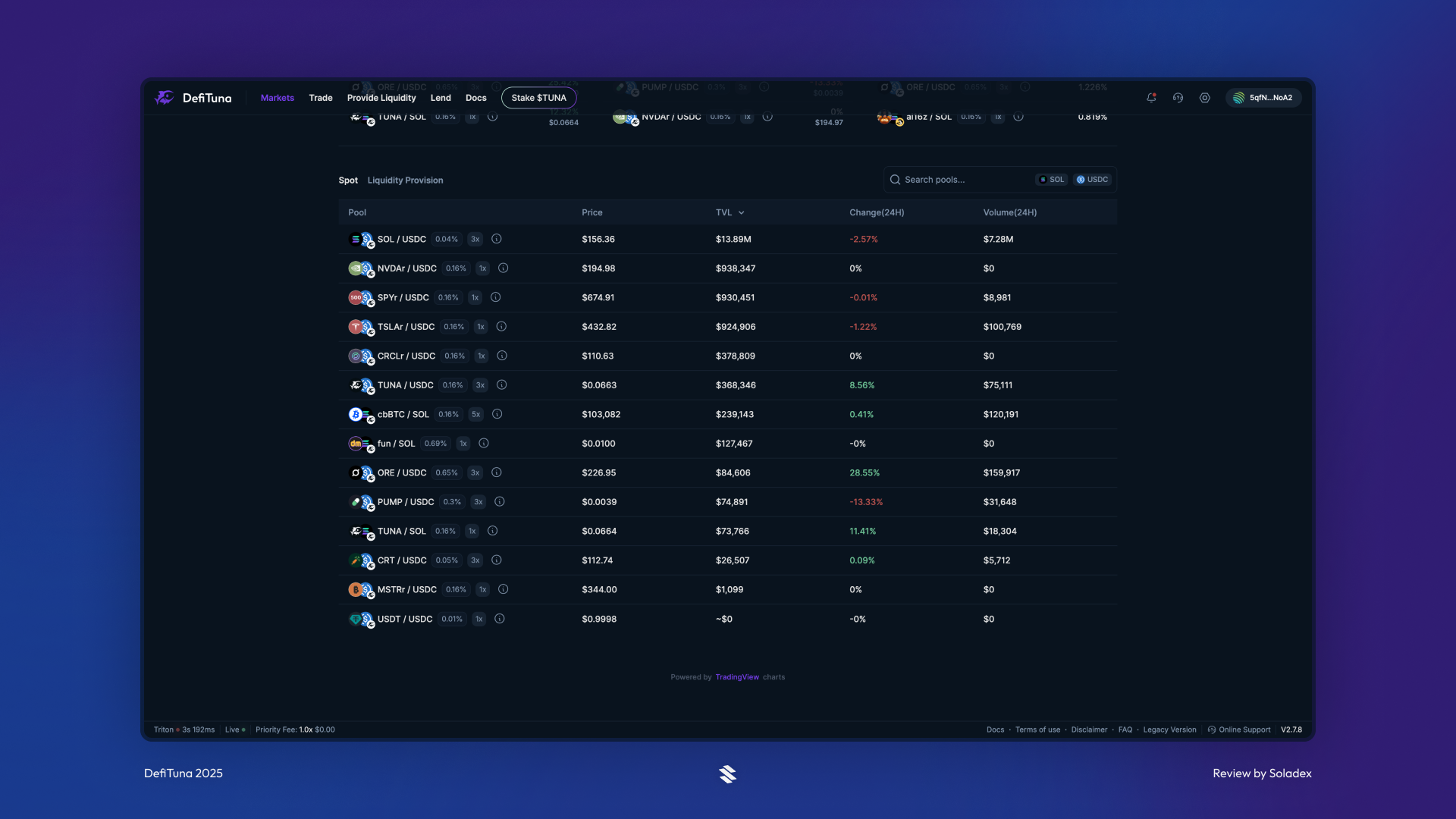

What are the DefiTuna Markets?

The DefiTuna market consists of two categories:

Spot markets

Ranked based on total value locked for the pairs available, the spots market consists of tokens in the DefiTuna pools.

Liquidity Provision markets

The tokens available on this market list are made up of LP pools from Orca and DefiTuna.

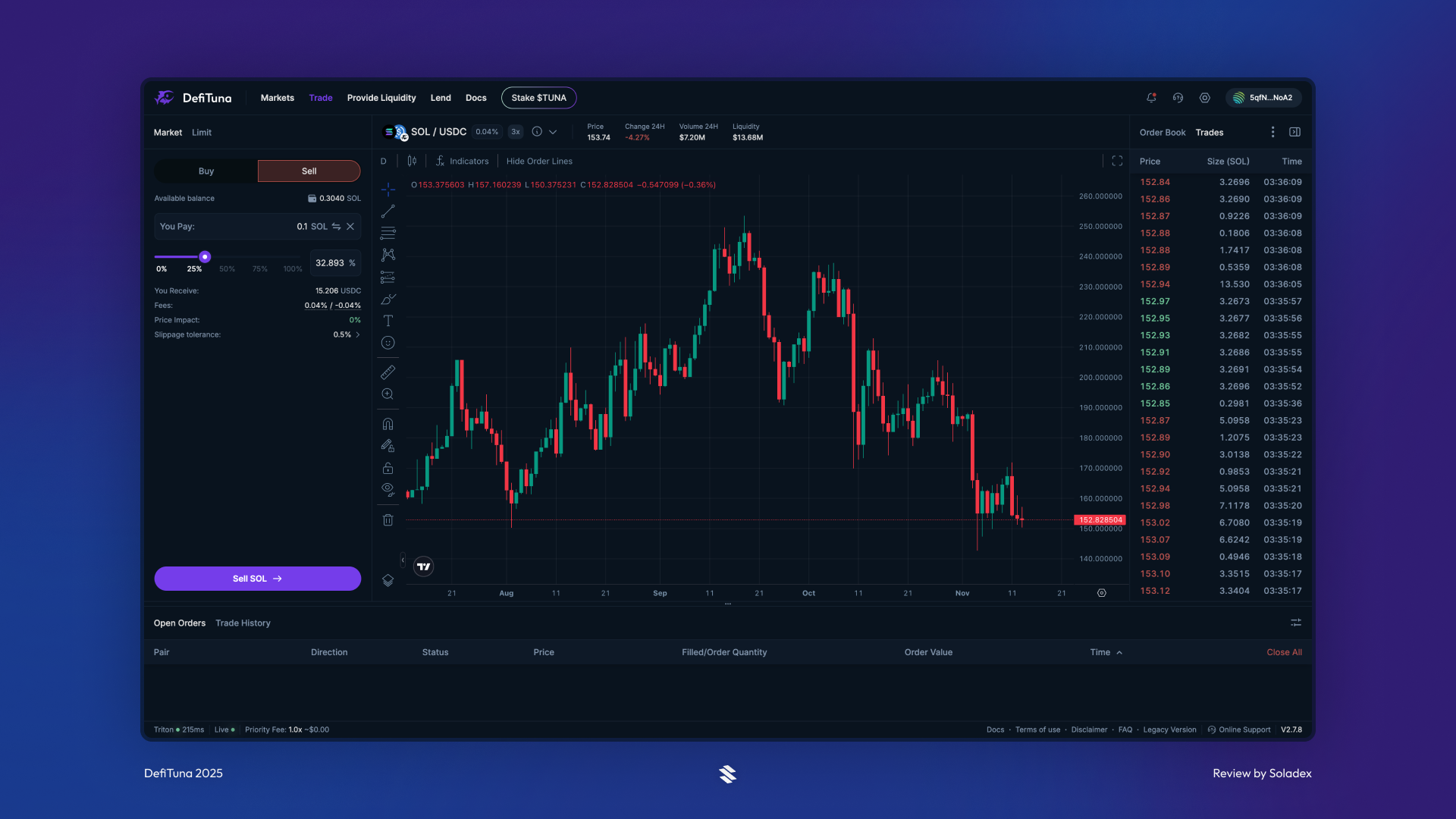

Trading on DefiTuna

The Trade page on DefiTuna brings together great trade execution and user-friendly design for traders on the Solana blockchain. DefiTuna uses its improved model for AMMs called Fusion AMM EEngine. It provides lower slippage and more reliable pricing. You can place market orders instantly or switch to the Limit tab to set a specific price; once submitted, your limit order is minted as an onchain SPL token and can be viewed in your Open Orders dashboard until it’s filled.

Provide Liquidity

Providing liquidity on DefiTuna means depositing tokens into concentrated liquidity pools that help power the platform’s spot market. As a liquidity provider, you act as a market maker, earning from trading fees and rewards as traders swap between assets within their chosen price ranges. In the Limit Order section, DefiTuna makes it possible for LPs to customize the price range that activates their liquidity for use.

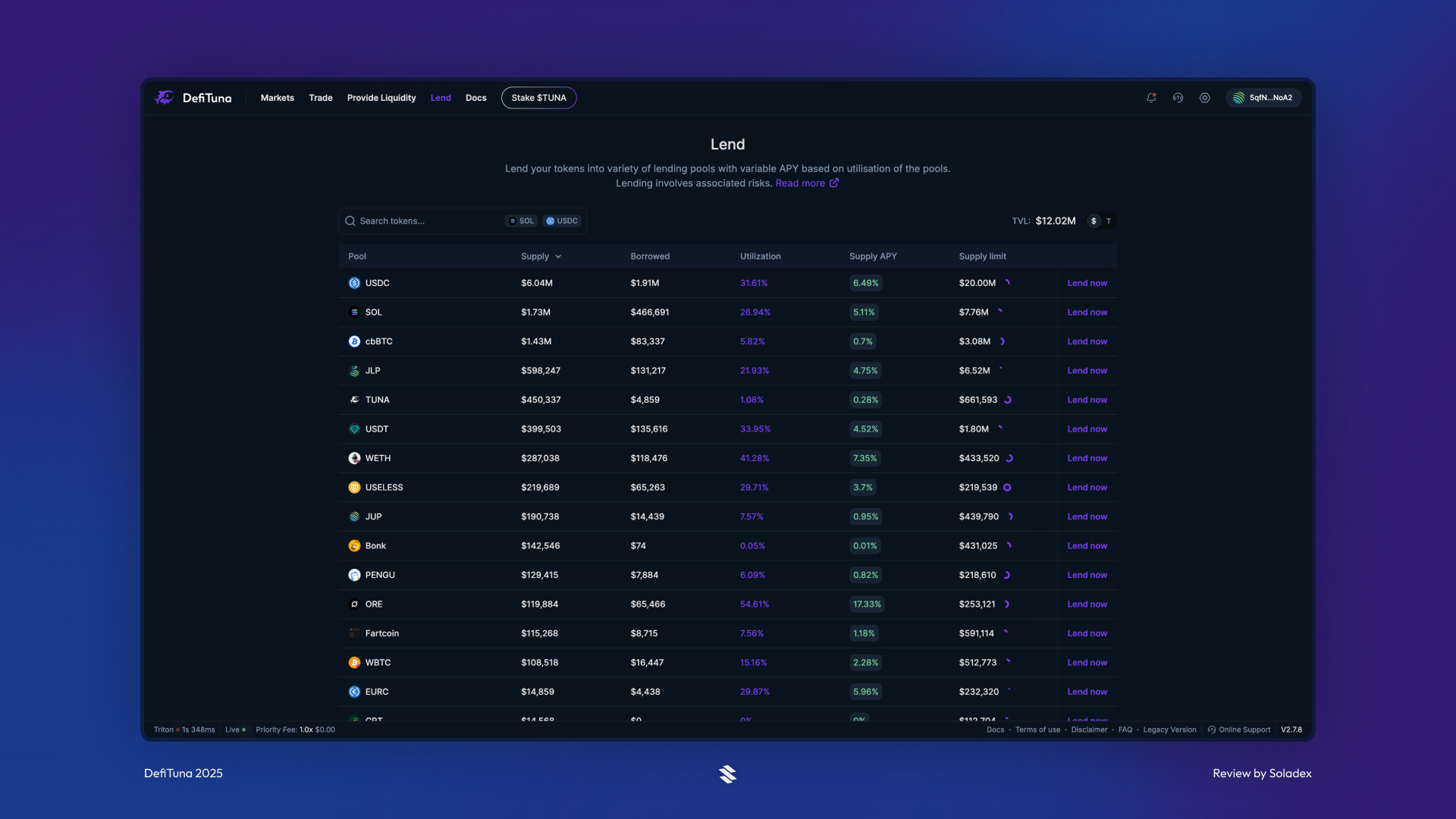

Lend

Users can lend their assets through the “Lend” tool to earn yield as they are. DefiTuna uses a curve-based interest rate model to adjust its APR for the tokens in its markets. You supply assets, earn interest and borrowers pay variable rates when utilization is high.

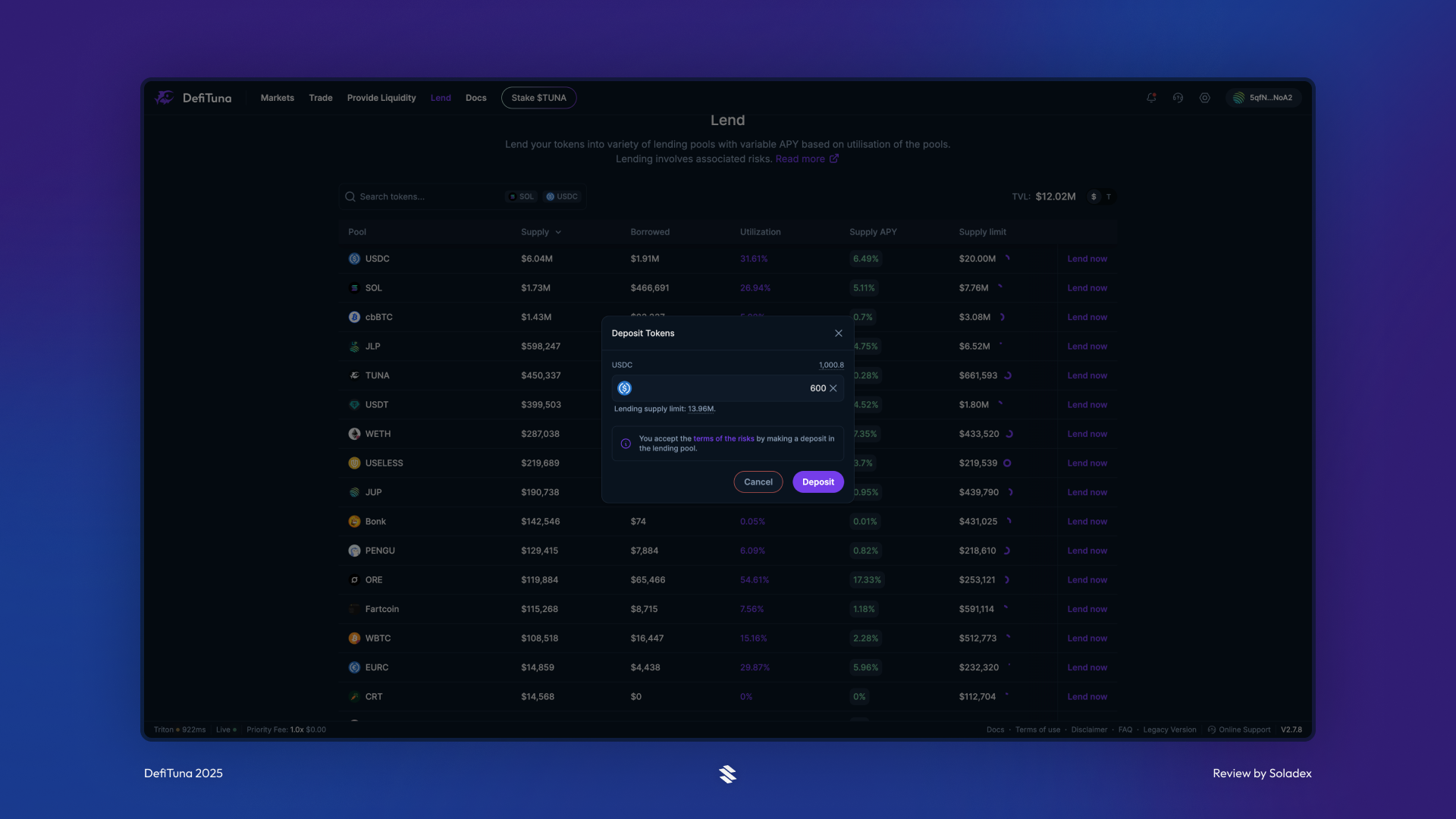

Select the token and input the value to be deposited in the lending contract.

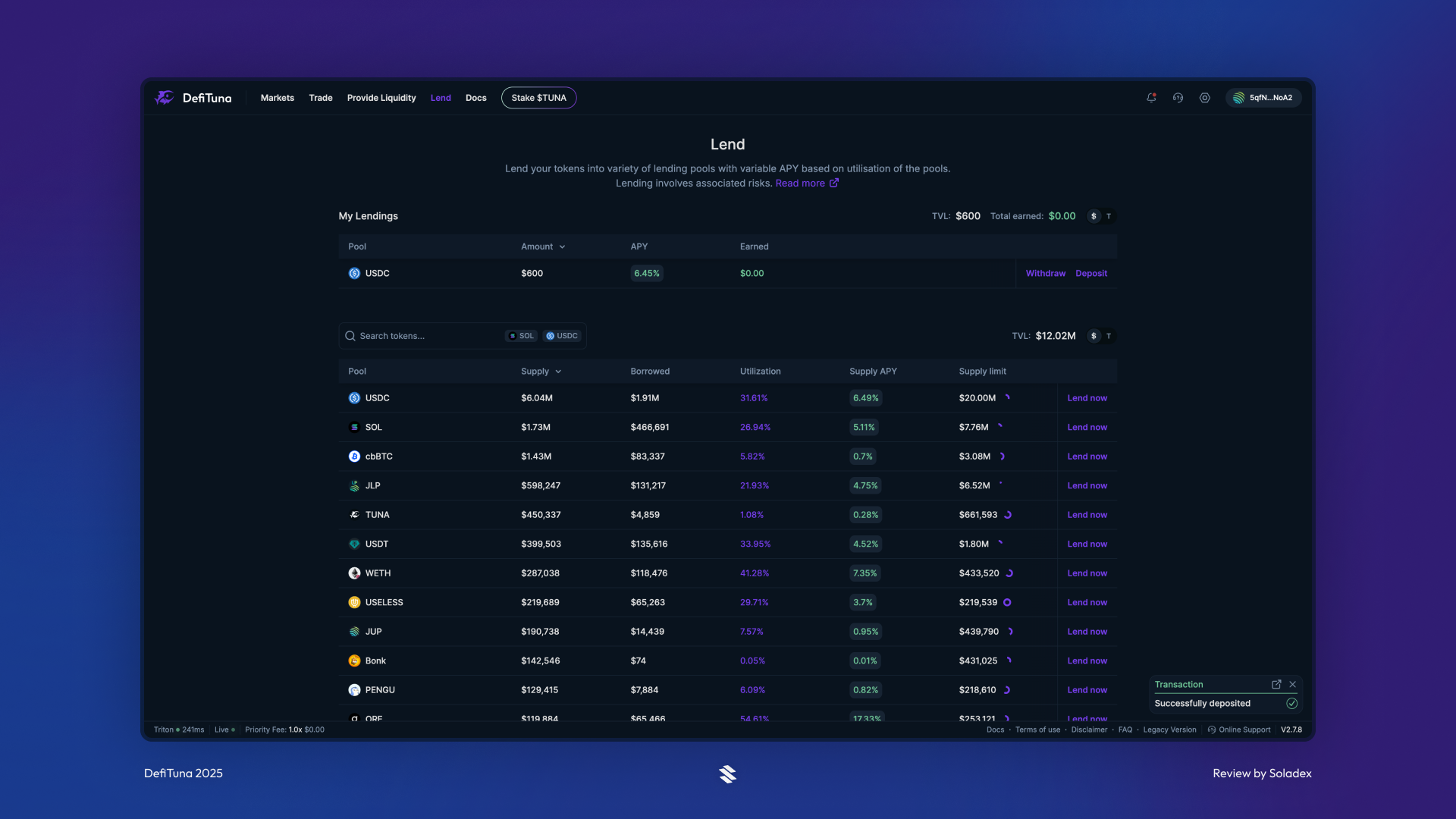

After depositing, you can view your positions in the “My Lendings” as shown below. To increase the deposit, click on “Deposit”. To remove liquidity from this lending pool, select the “Withdraw” option.

Conclusion

DeFiTuna offers a great tool for the Solana DeFi ecosystem. The protocol integrates trading, liquidity, lending and leverage into one platform to make all of these activities easier for the regular DeFi enthusiast and traders. If you’re an LP looking to deploy capital more, a trader who values advanced order types, or a lender who wants dynamic yield, DeFiTuna is a Solana-native tool that works well.