What Is Elemental?

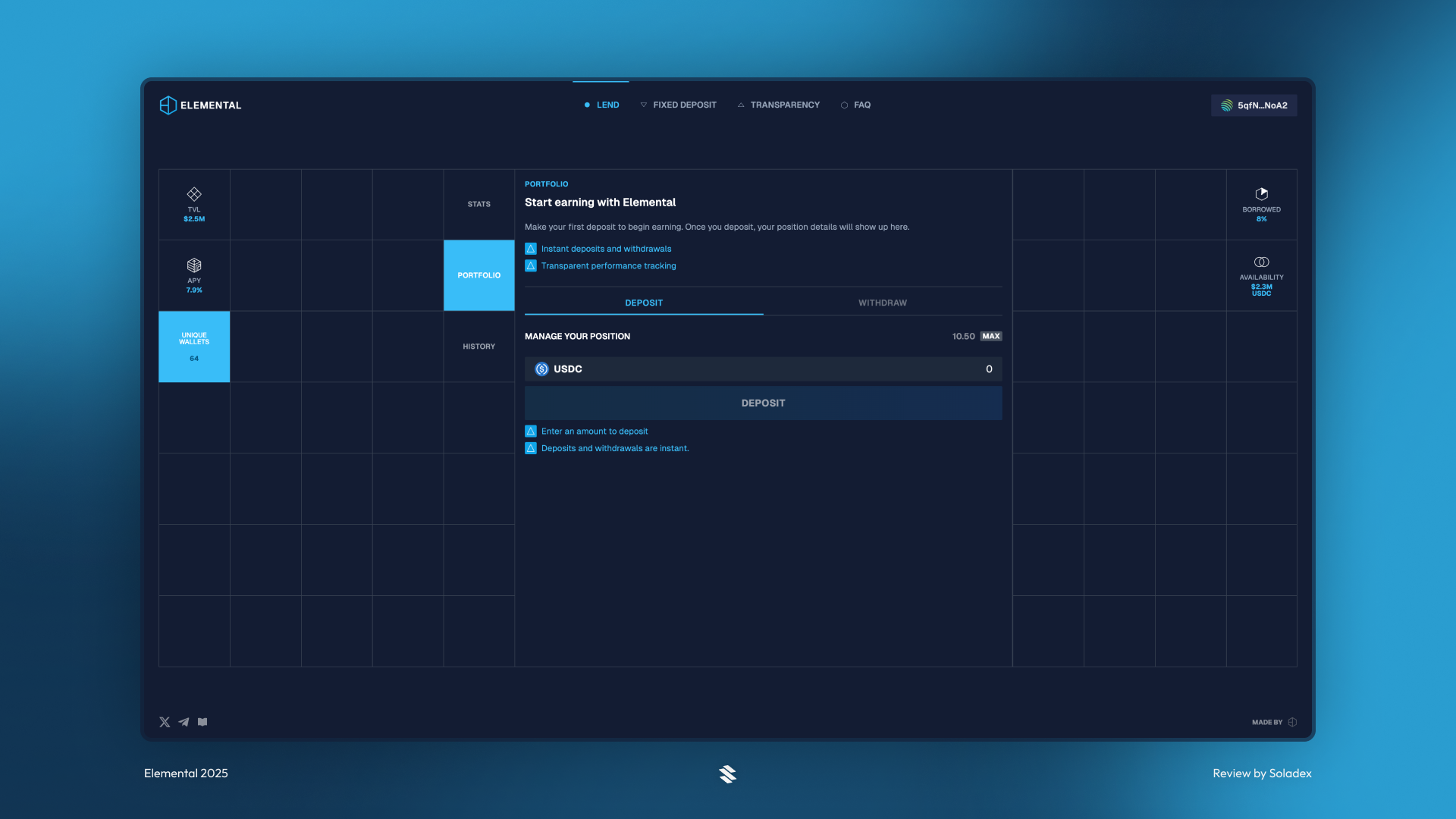

Elemental is a decentralized crypto fund built on the Solana blockchain that allows users to earn yield through professionally managed DeFi strategies. Instead of navigating lending, liquidity provision, or arbitrage across multiple protocols, users can deposit funds into Elemental and gain exposure to a diversified strategy designed to optimize returns. All strategies have their risk management systems included to prevent losses for depositors.

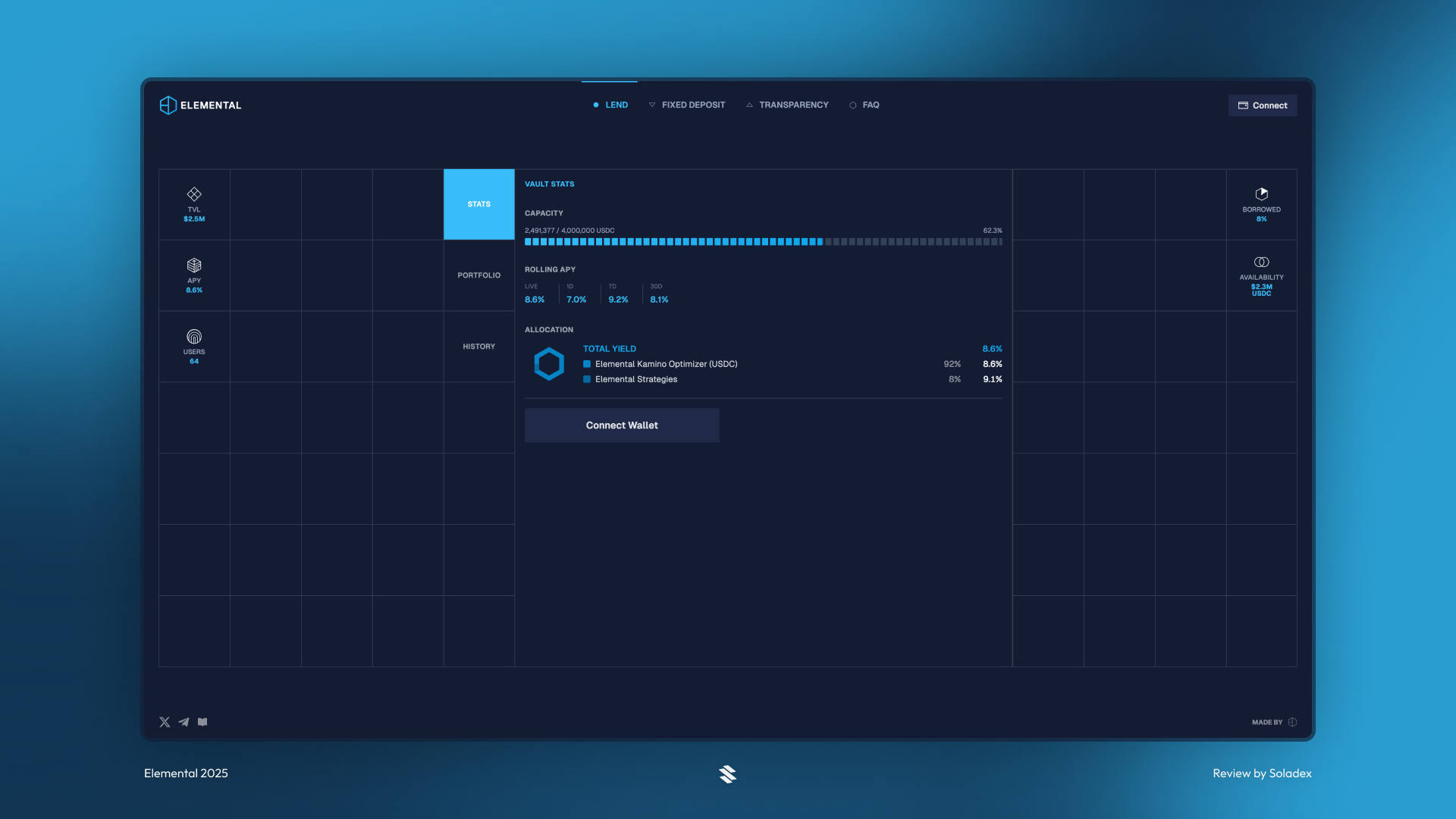

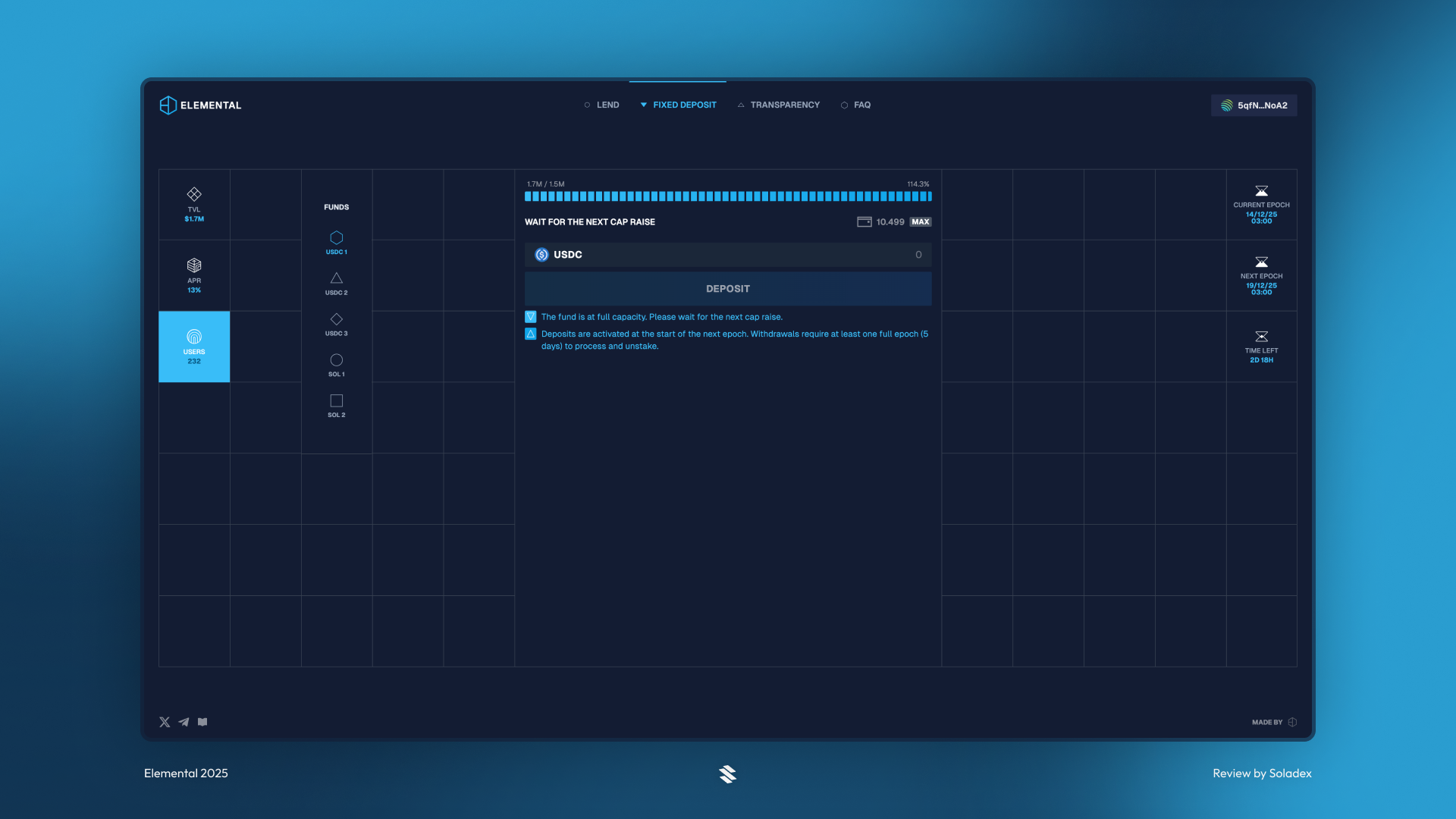

Elemental currently supports deposits in USDC and SOL. The USDC-1 fund shown below is at full capacity, and no new deposits can be added.

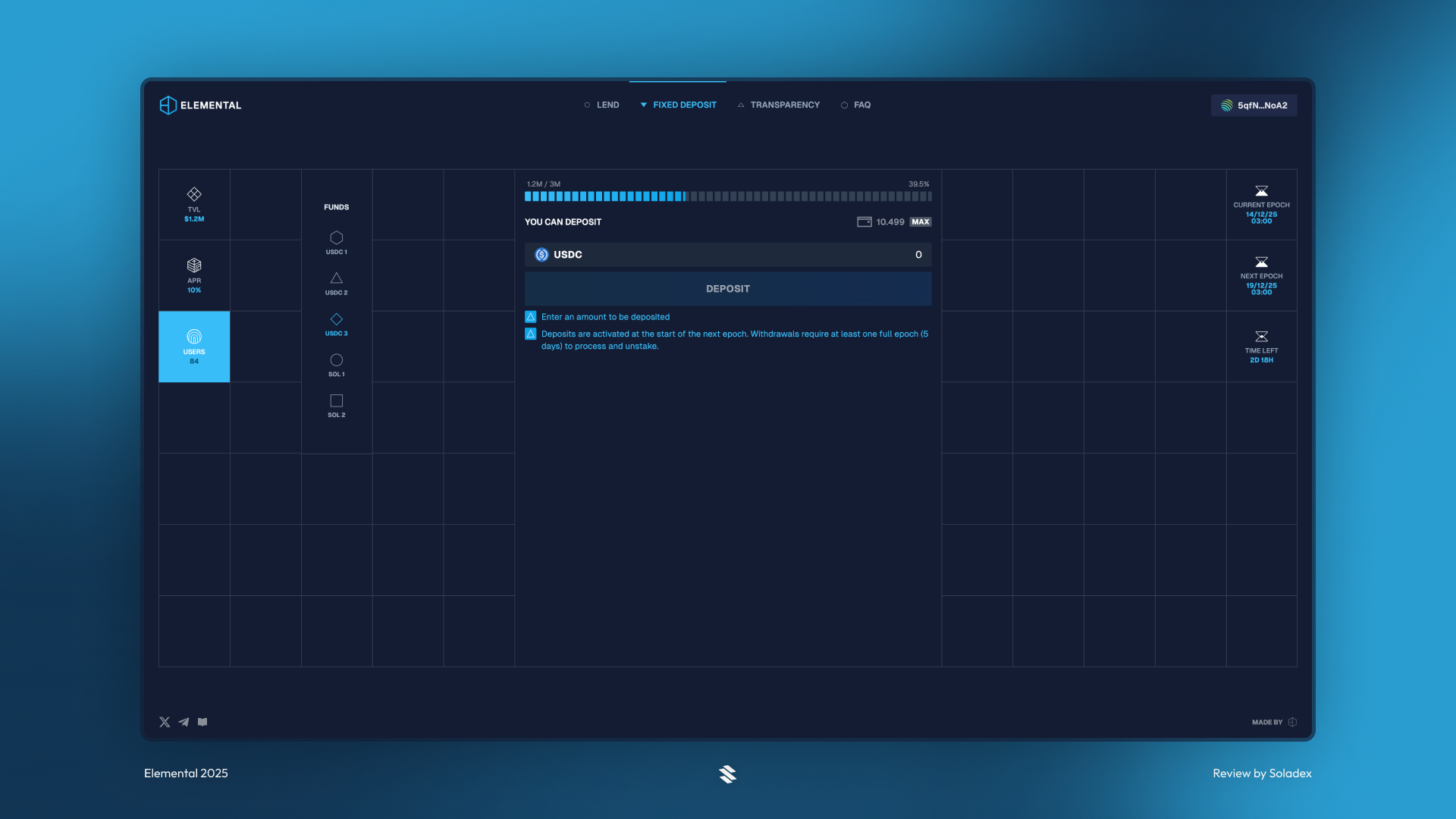

The deposits in USDC 3 and SOL 2 are still open for more deposits, as the caps have not been reached.

All positions are represented as SPL tokens and are managed fully onchain across multiple funds of varying capacities.

How Elemental Works

Elemental operates on a fixed epoch system, where its epochs last five days. When users deposit funds, those funds become active at the start of the next epoch. During an epoch, Elemental deploys capital deposited across various Solana DeFi strategies such as funding rate farming, lending loops, liquidity provision, and arbitrage opportunities.

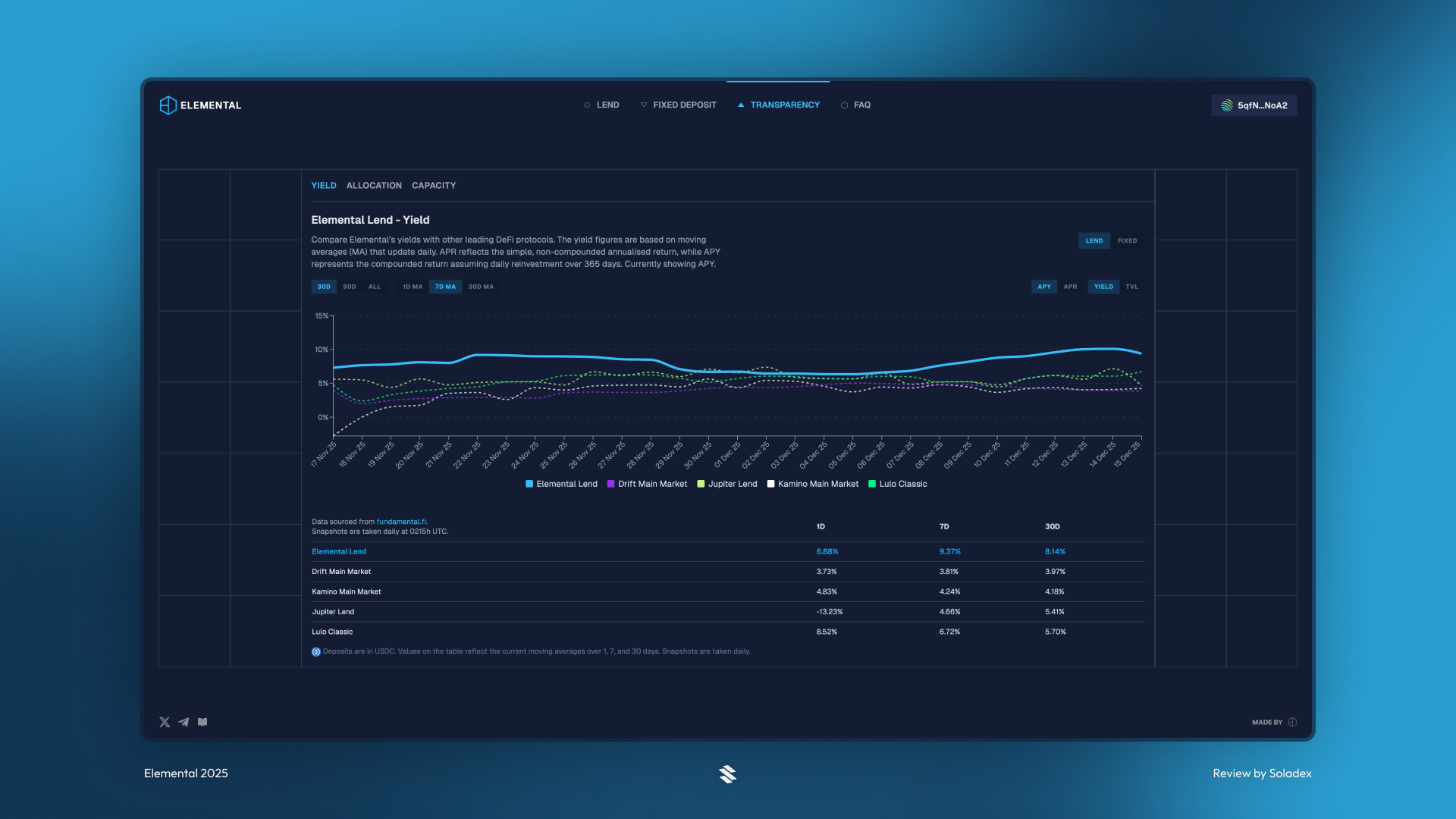

Each epoch has a predefined yield rate based on prevailing market conditions. Once an epoch begins, the yield for that period is locked in and credited at the start of the epoch. This structure provides predictability compared to constantly fluctuating APYs. The epoch-based model offers users clearer expectations for returns, while its diversified strategy reduces reliance on any single protocol or yield source. For users who want exposure to Solana DeFi without actively managing positions, Elemental offers a great alternative that remains fully onchain and transparent.

The Elemental transparency dashboard has a TVL section that helps visualize the total value locked in the protocol. The Elemental Lend TVL at the time of this writing is about $2.5m.

Deposits and Withdrawals

Deposits made during an ongoing epoch do not earn yield until the next epoch begins. Similarly, withdrawals require users to wait through a full epoch so the fund can unwind positions safely. During the unstaking period, funds do not earn yield, but any yield earned for the current epoch is already credited.

This delayed withdrawal model allows Elemental to run more complex and capital-efficient strategies without forcing sudden exits that could harm performance.

Risk Management and Safeguards

Elemental acknowledges that DeFi comes with a heavy risk, such as smart contract exploits, token depegging, and sharp market volatility. To mitigate these risks, the protocol maintains an Insurance Fund and a Compound Fund, which act as buffers against losses during unfortunate occurrences. In extreme scenarios where losses exceed these reserves, remaining losses are socialized proportionally across depositors. This transparent approach ensures users understand both the upside and the risks involved.

Conclusion

Elemental is designed for users who want consistent, managed exposure to DeFi yields on Solana without the complexity of daily position management. With its epoch-based structure, diversified strategies, and clear risk disclosures, Elemental positions itself as a practical option for earning yield in a fast-moving DeFi ecosystem.