What is Kamino?

Kamino is a DeFi platform that helps users earn yield automatically by managing depositors' liquidity and lending on the Solana blockchain. Kamino simplifies and reduces the need for manual trading and regular position adjustments.

How Does Kamino Work?

Kamino is not a single application. It comprises multiple applications and features that have turned Kamino into an ecosystem of Solana-native products. The following are some of the products offered by Kamino:

Earn (Lending)

Kamino allows users to supply their cryptocurrency assets and borrow desired tokens easily. This is the most used feature for people trying to earn money on their idle assets. Funds deposited here are deployed to a specific vault of your choice and are spread across the Kamino Lend Markets, where assets are rebalanced automatically to earn yields in an optimized way. The vaults are managed by professional risk managers who are able to carefully allocate capital to generate earnings for the deposits in their vaults.

There are multiple risk managers, and you can select any of them based on the level of risk they are willing to bear. A vault can be categorized as Conservative, Balanced or Aggressive.

Conservative vaults are for markets with tokens of high liquidity and are conservative in their approach to lending, while the Balanced vaults lend across a range of assets from the highly liquid to the new assets. The Aggressive vaults are designed to maximize earnings by deploying liquidity across any market.

Markets

In this section, all the markets exist for depositing assets and borrowing funds. These markets are in different categories based on the type of market they belong to.

A category in this market is the xStocks Market. xStocks is a market that exposes a trader to stocks on Solana, where the x-tokens are backed by the underlying security that their names represent. For example, GOOGLx represents Google stock, and the value corresponds to the value of Google stock. These x-tokens do not give a trader the legal or voting rights to the underlying tokens.

How It Works

The Kamino Markets is the avenue for the regular user to supply and borrow assets.

Supply Assets

You can deposit your cryptocurrencies, such as USDC and SOL, into the general markets to earn interest. The yield earned comes from the interest from borrowers and other protocol incentives.

Borrow Assets

After supplying the asset that is now your collateral, such as USDC or SOL, Kamino weighs the value of your holdings and determines its loan-to-value (LTV) ratio. This puts a limit on your borrowing capacity to help preserve your assets as best as possible.

Liquidity Pools (LP) Positions as Collateral

Kamino Lend allows users to use their concentrated liquidity positions (CLPs) as collateral. This feature creates additional capital efficiency by enabling liquidity providers to borrow without needing to exit their LP positions.

Liquidations

Kamino manages the risks involved in Lend by monitoring the market value of all cryptocurrency assets on the protocol to protect the lenders and the borrowers. If a borrower's collateral value drops below the safe margin based on the loan-to-value ratio, the borrower's assets will be liquidated to maintain protocol solvency.

Liquidity

In the Kamino ecosystem, liquidity is the availability of assets within its automated liquidity vaults and general markets, which keep the Kamino protocol activities running. All the protocol's trading, swapping, lending, and borrowing activities are possible because of the liquidity available. Kamino optimizes liquidity provision on decentralized exchanges such as Orca and Raydium. These liquidity vaults help liquidity providers manage their positions more efficiently by automating manual processes such as rebalancing, compounding, and position adjustments.

How Liquidity Works in Kamino

Automated Liquidity Vaults (ALVs)

Kamino manages concentrated liquidity positions on DEXs such as Orca Raydium, and it auto-rebalances the liquidity range in the positions. Users earn trading fees and incentives, which are auto-compounded for higher returns.

Liquidity Pools from Kamino Lend

Users supply assets (e.g., SOL, USDC) to Kamino's lending pools to provide liquidity for borrowers. Borrowers access this liquidity by collateralizing their assets or LP positions.

Why Liquidity Matters in Kamino

Kamino's liquidity solutions create a more capital-efficient and automated DeFi experience for Solana users. Its benefits can be summarized below:

Higher Capital Efficiency

LP positions can be used as collateral to create a chain of additional liquidity.

Automated Yield Optimization

Liquidity is actively managed to maximize returns.

Deep Liquidity for Solana DeFi

Kamino improves DEX trading efficiency on Solana and supports leveraged borrowing.

Multiply Vault

Kamino created a leveraging solution for liquidity providers called Multiply. The Multiply Vault is for users who want to boost their LP exposure through the assets within Kamino without manually managing the leverage needed. Multiply helps you to maximize liquidity farming return while reducing active management.

How Does the Multiply Vault Work?

Automated Leverage for LPs

Users deposit funds into the Multiply Vault, Kamino borrows additional assets and reinvests them into concentrated liquidity positions (CLPs). This creates the leveraged LP position for the user.

Debt and Collateral are Managed Automatically

Kamino automatically monitors collateralization levels and adjusts positions to prevent liquidation risks of users' assets. The vault rebalances as necessary.

Higher Yield Potential

Because users leverage their assets, they earn more fees and rewards from the liquidity pool. This yield is auto-compounded with increasing returns over time.

Swap

Kamino added a swap application for easy token exchange in the Kamino app. Swap removes the stress of connecting to other DeFi exchanges to perform token swaps. Powered by Pyth, the swap protocol is still in Beta but serves users excellently.

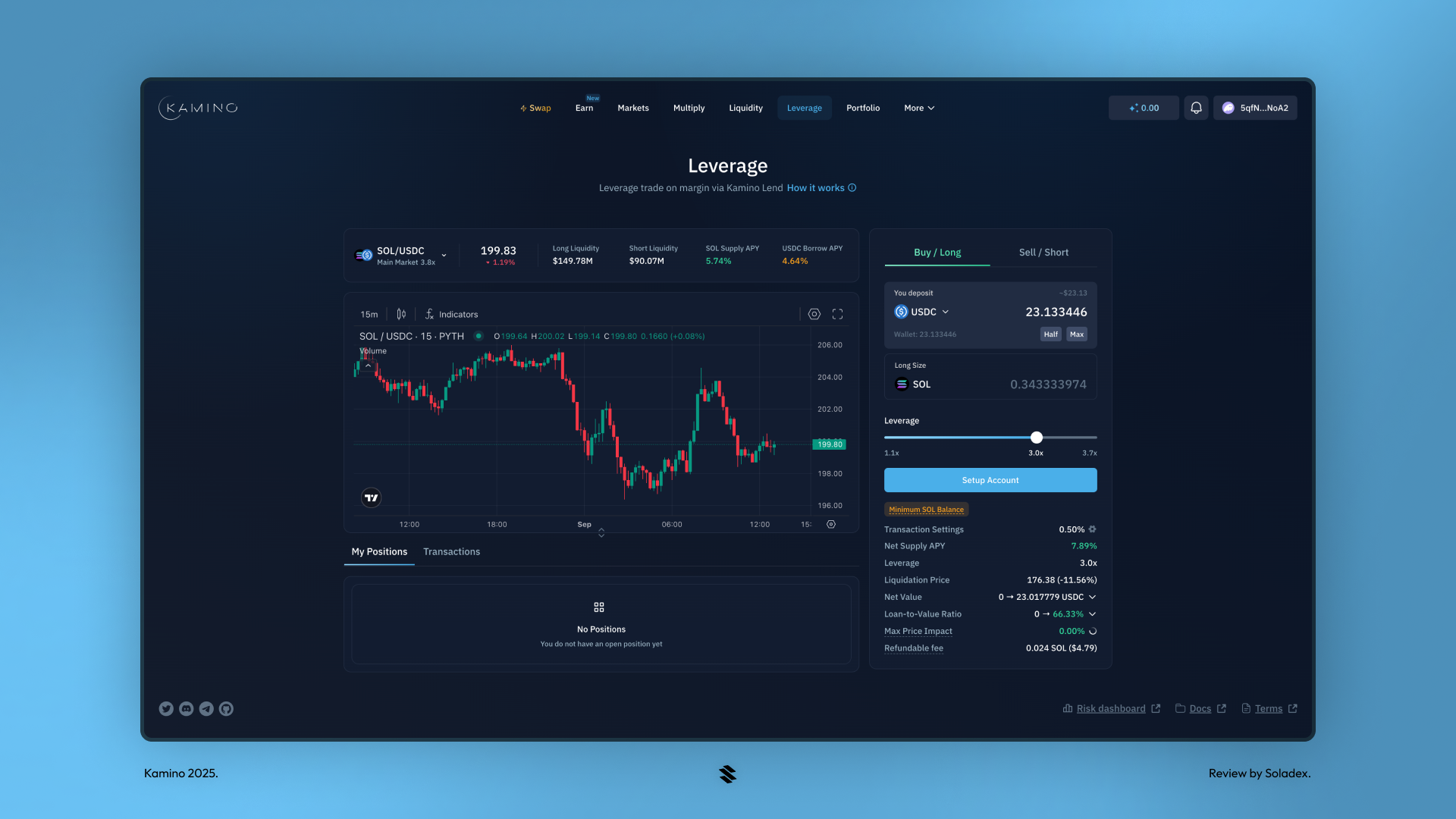

Leverage

Kamino allows users to take long or short positions powered by its lending and liquidity protocols. This feature enables directional trading, where users can increase exposure (long) or hedge (short) specific assets within the Kamino ecosystem.

How It Works

Long (Bullish Strategy)

Users borrow assets (e.g., SOL, USDC) from Kamino Lend to buy more of the same asset. This increases exposure to the asset, profiting if the price rises.

Short (Bearish Strategy)

Users borrow an asset they expect to decrease in value (e.g., SOL) and sell it for a stablecoin. If the price drops, they repurchase it at a lower price, repay the loan, and keep the profit. This is useful for hedging against market downturns.

By selecting a long or short trade on a particular token, the performance of the trade based on current market data is simulated to provide what will be gained or lost.

Portfolio

Deploying liquidity, lending and borrowing of tokens can become cumbersome for the average user, especially if there are many open positions on Kamino. To solve this, Kamino provides a dashboard that helps monitor the profit and loss value of all open positions and the fees earned. Portfolio provides all these positions in a single interface for easy management.

Conclusion

Kamino smoothens DeFi on Solana by combining automated liquidity management, lending, and leverage into a capital-efficient ecosystem. Kamino lets its users passively earn yield, borrow cryptocurrencies, borrow against LP positions, and take leveraged long or short positions with auto-optimized risk management. Whether you're a yield farmer, trader, or liquidity provider, Kamino provides the tools to deploy capital efficiently in Solana's DeFi ecosystem.