What is Save?

Save Finance is one of the oldest DeFi lending and borrowing protocols built on the Solana blockchain. It allows users to deposit cryptocurrency into lending pools and earn interest, or borrow using their deposited assets as collateral. Save used to be called Solend, but the team changed its name to reflect its rebranding. It supports many Solana assets, stablecoins, and aims to give users flexible borrowing (including no fixed repayment deadlines) and passive yield on deposits.

How Save Finance Works

You deposit supported tokens (SOL, USDC, etc.) into Save’s liquidity pools. Your funds become available to borrowers, and you earn interest from those loans. You borrow assets against what's in your wallet or deposit. Your collateral stays locked until you repay; interest keeps accumulating, but there’s no fixed due date for repayment.

SAVE Token

Following the protocol rebrand, the SLND token was converted to the SAVE token on the Solana blockchain. Users stake or hold the SAVE token for governance, vote on proposals, and share in some protocol revenue or incentives. As an incentive for holders of SLND, the Save protocol gifts users who convert their SLND a certain amount of mSEND tokens that can be bridged to Sui and then converted to SEND, the protocol token of the Suilend lending platform. This lending protocol was built by the team behind Save for the Sui blockchain.

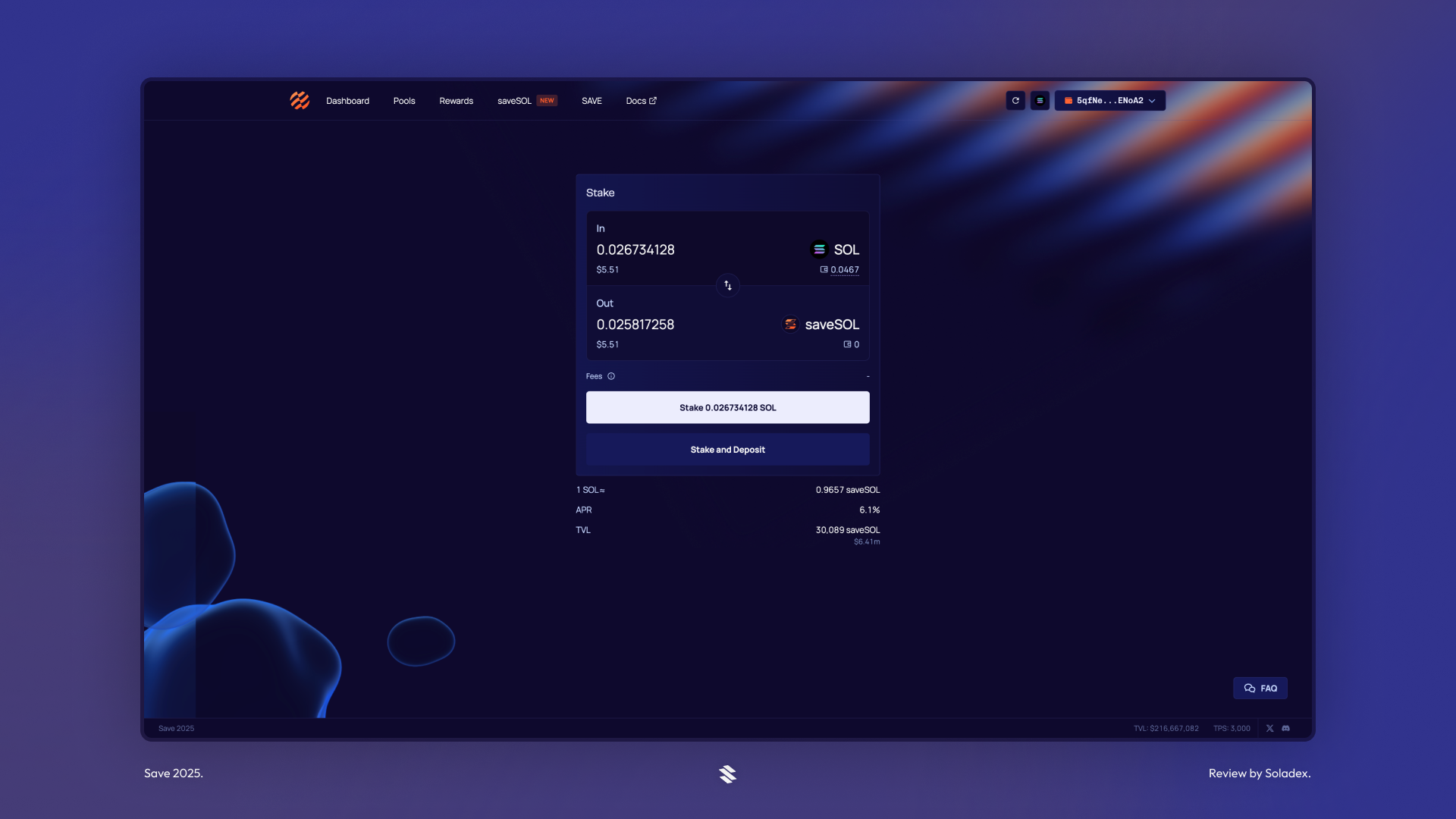

saveSOL Token

Save has its staked SOL that can be used in DeFi activities. By staking SOL with Save protocol, you receive staked SOL (saveSOL).

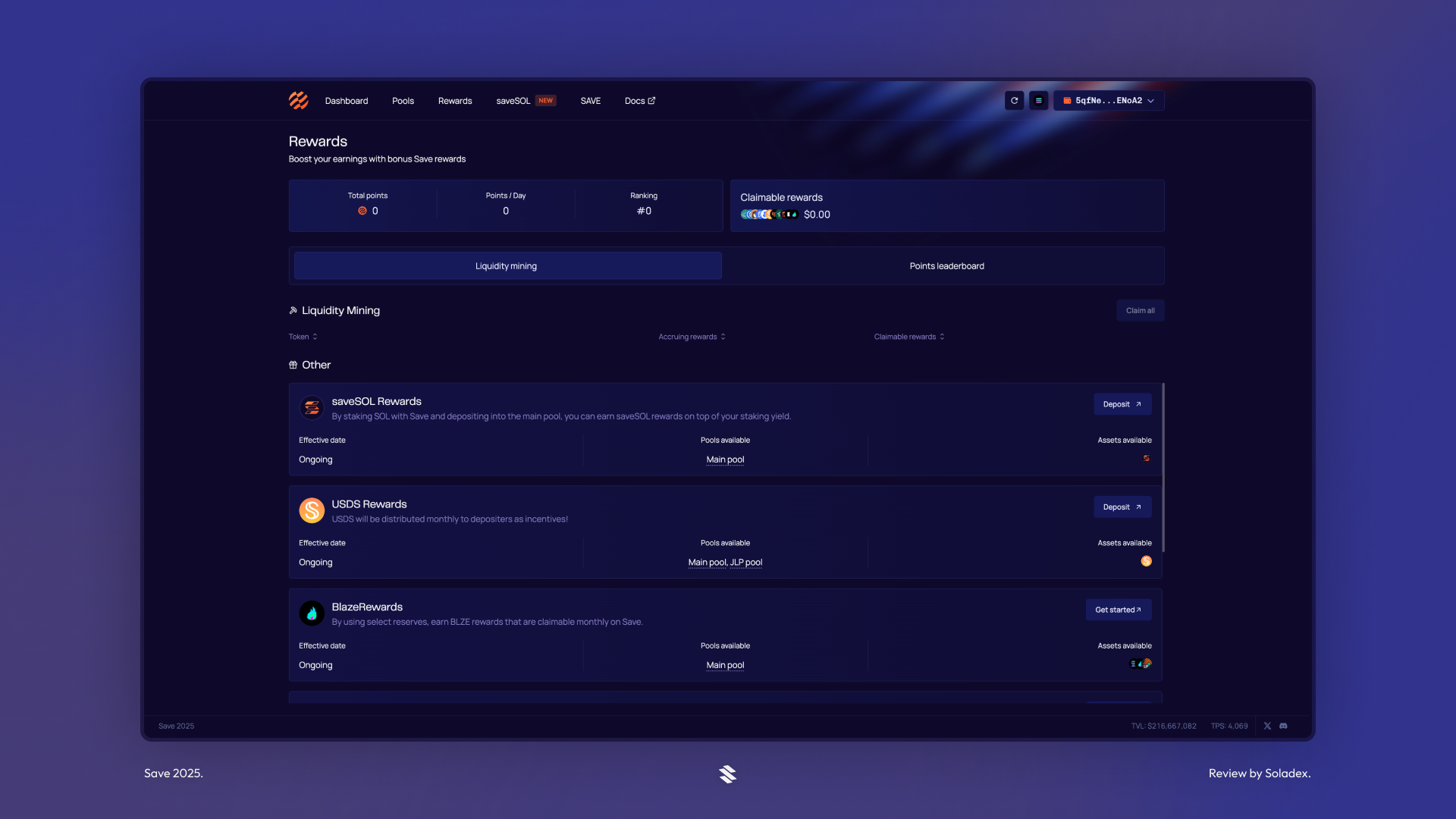

Rewards

By depositing funds in Save, users are eligible to receive a share of the rewards generated from the pools where they have made a deposit. The rewards received from the pool are distributed among those who put in the funds that borrowers use.

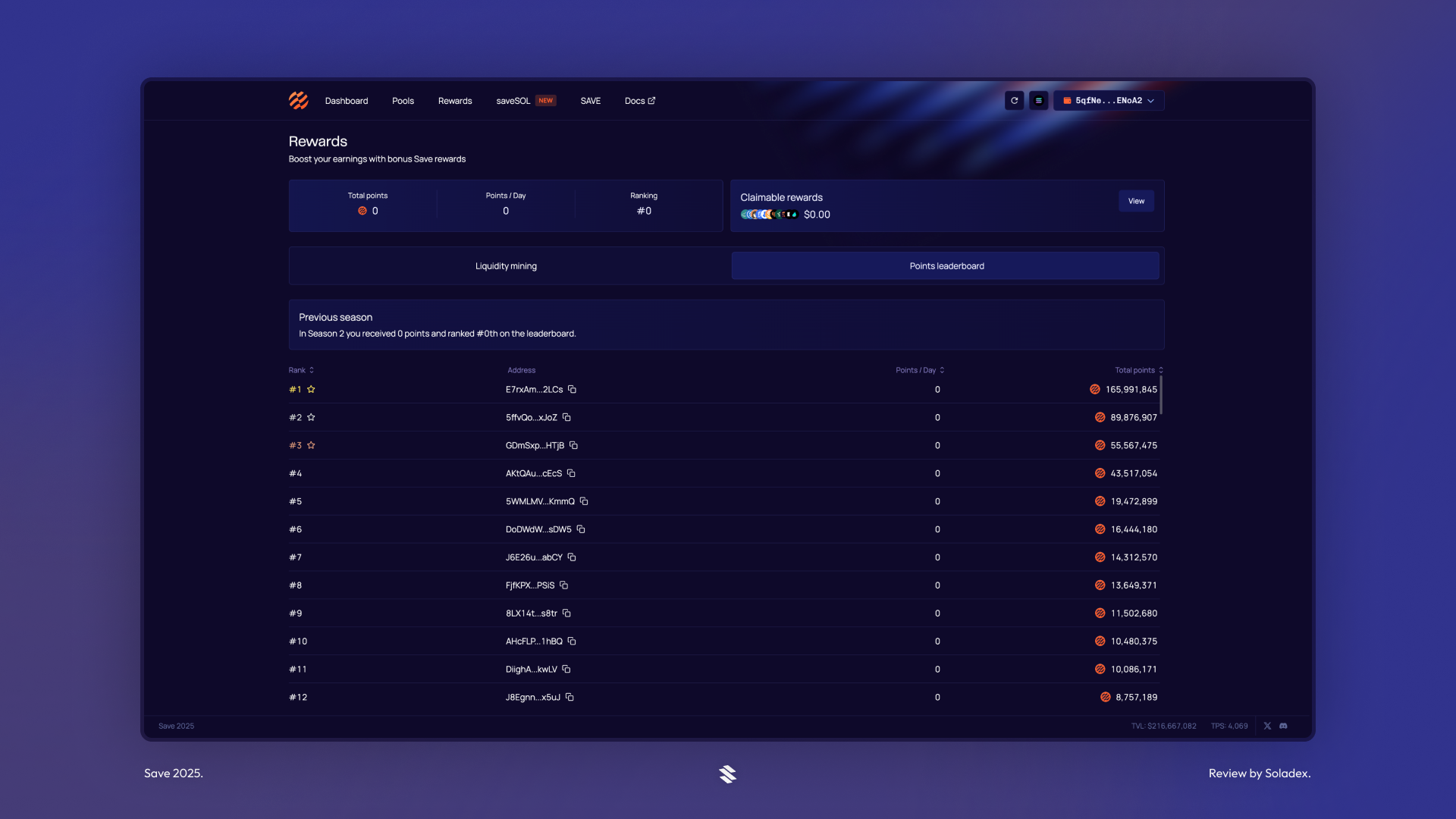

Save also uses a points system where users of the protocol are ranked based on the value of their lending account over time.

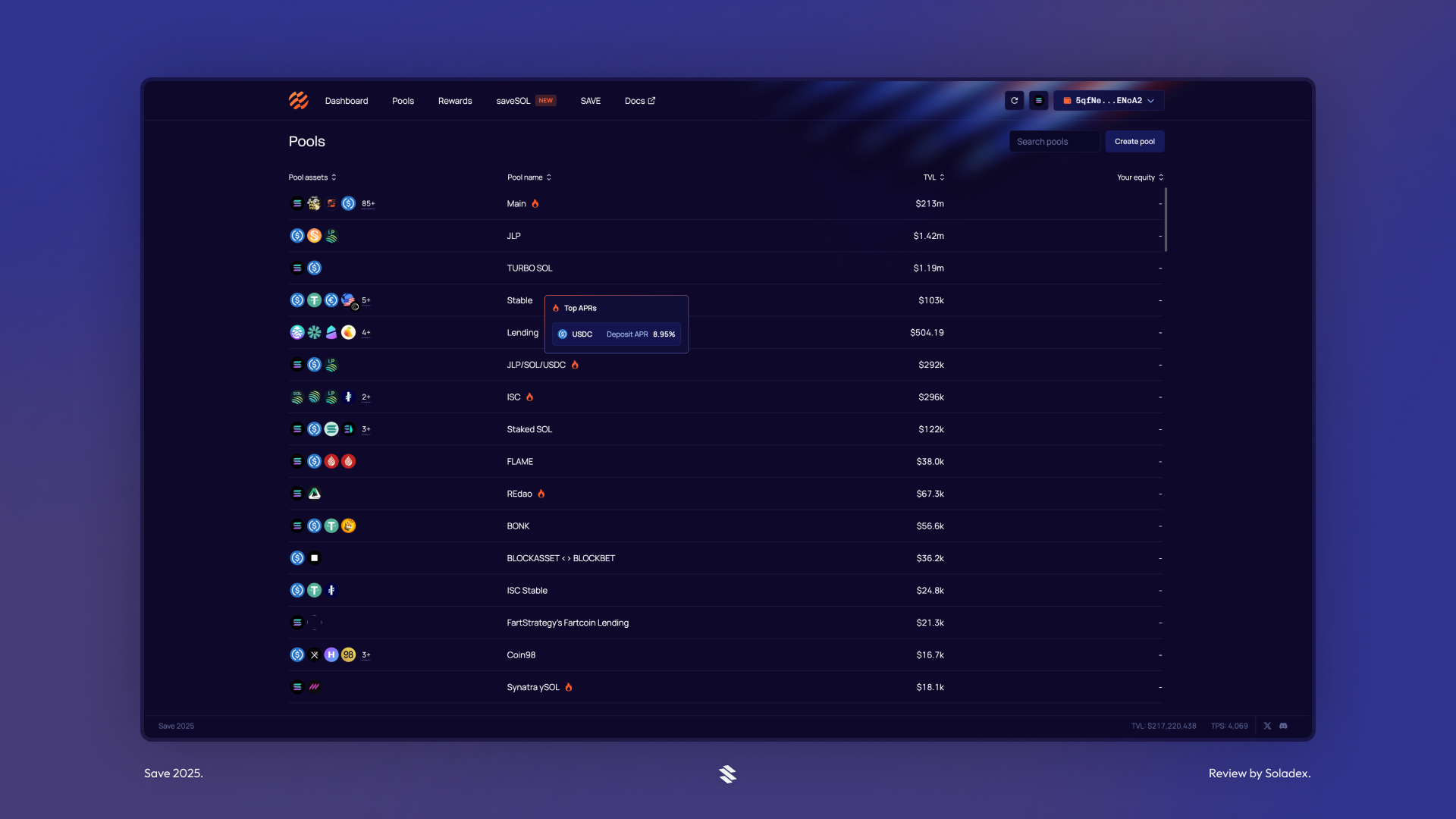

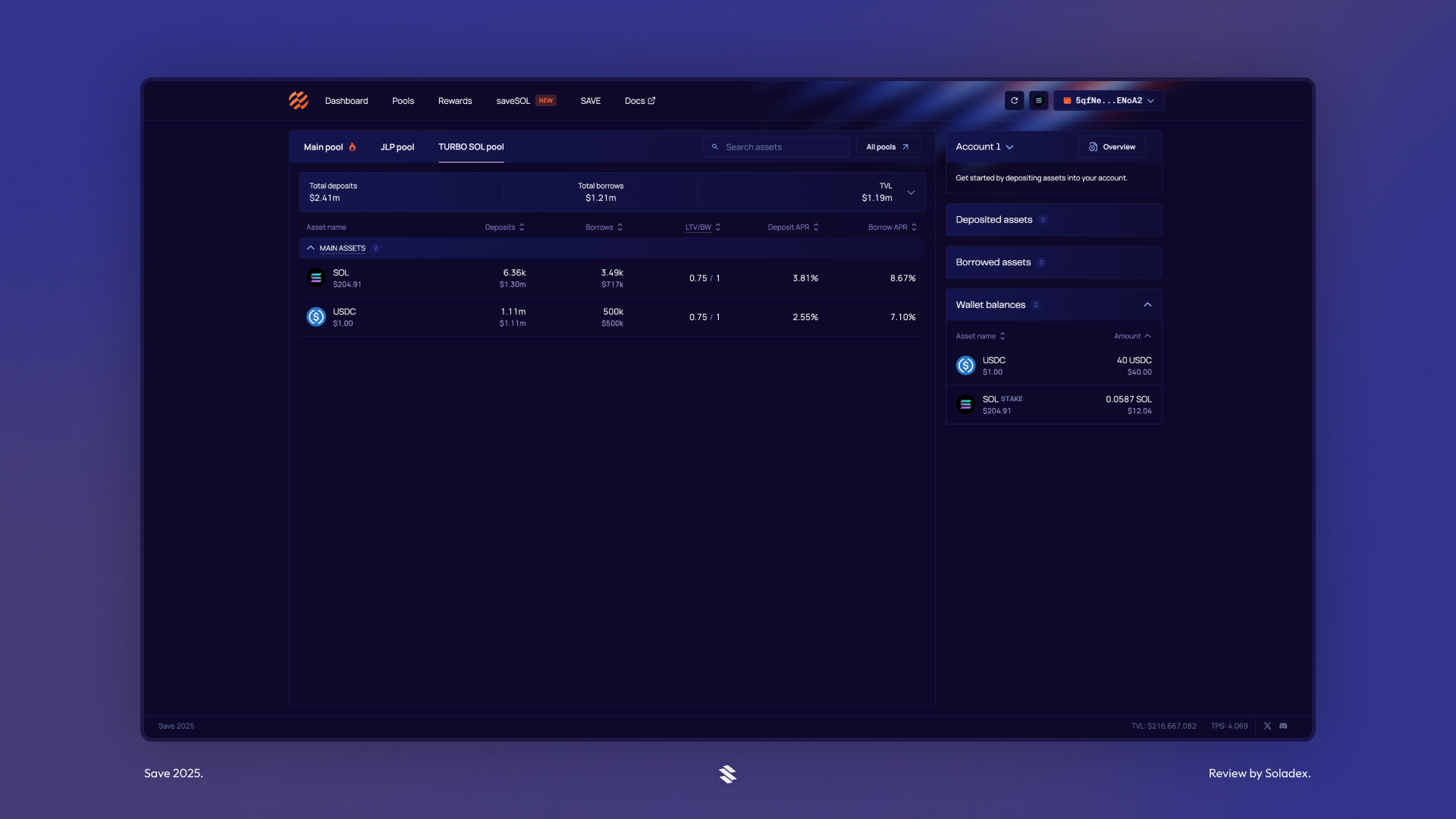

Save Pools

Pools are lending markets where users deposit assets (like USDC or SOL) to earn yield, while others borrow those same assets by providing collateral. Each pool has its own risk parameters, interest rates, and the assets it supports.

Main Pools

Main Pools are Save’s major lending & borrowing markets. Tokens listed in these pools have undergone stricter risk filters to ensure good liquidity, reliable oracles, and stable behaviour, such that users can deposit assets in tokens that have been tested in the market.

Other Pools

There are other pools, such as the Turbo Pool and the JLP Pool, catering to different asset categories.

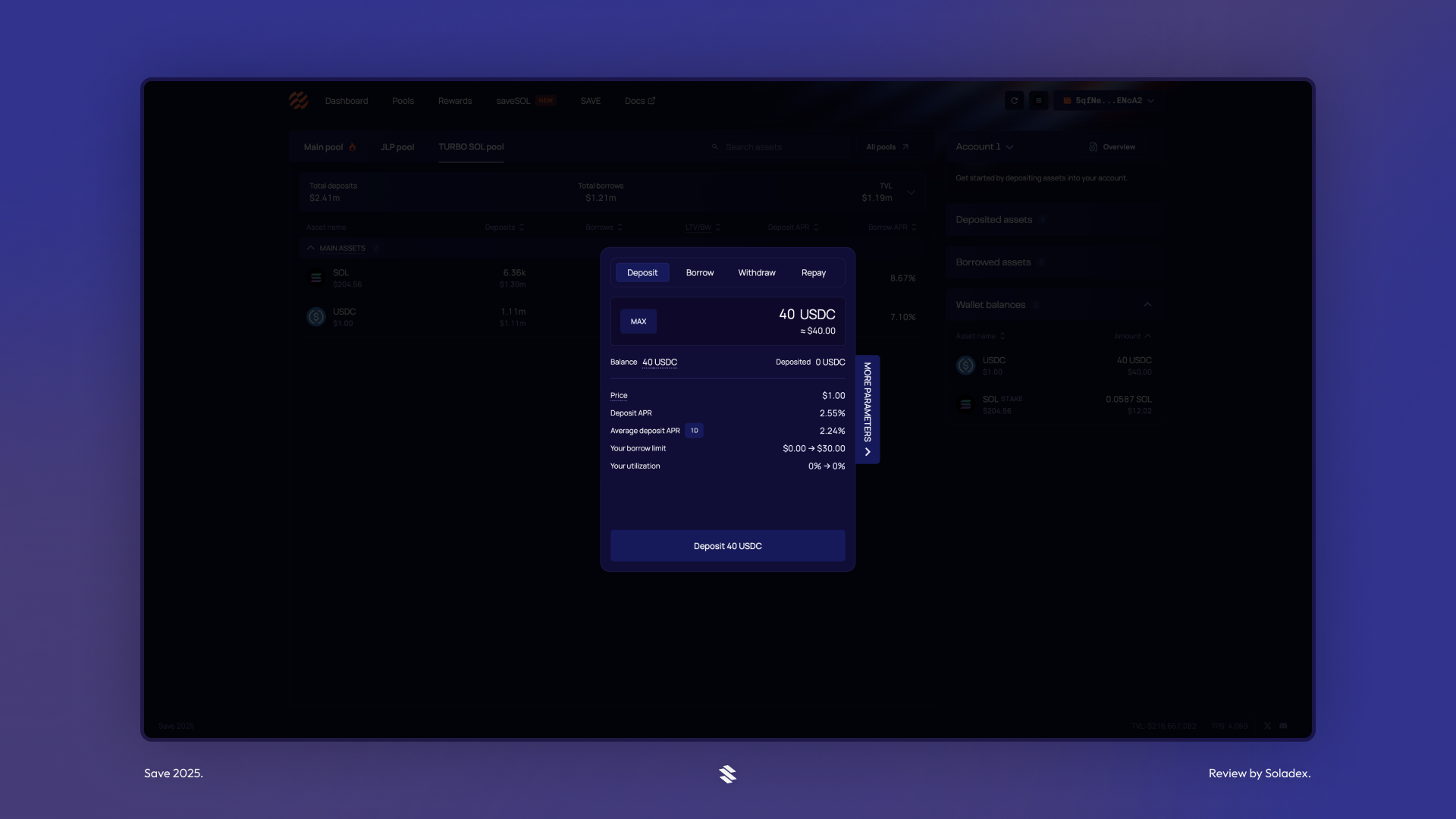

Depositing and Borrowing Funds

Select the pool where you want to deposit your asset, and the interface below is displayed. In this example, I deposited $40 in the USDC section of the Turbo SOL Pool.

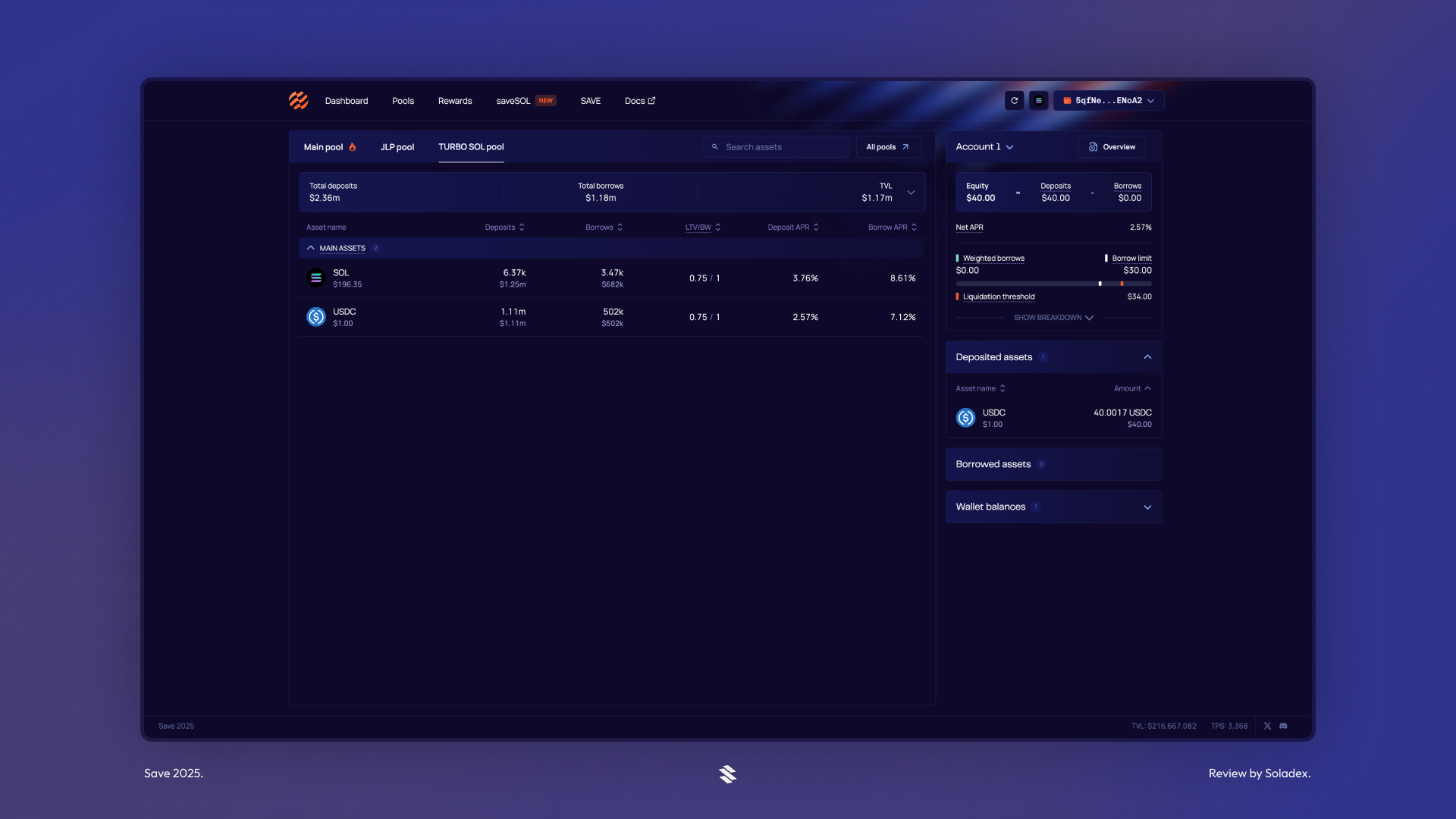

Now I can borrow as high as $30 for the $40 that I have in the USDC pool, as shown below.

Liquidation of Assets

If you did not deposit a stablecoin, as in the example above, and the value of your collateral drops significantly against the loan you borrowed (due to market swings), then your position can be liquidated to protect the lenders from incurring a loss.

Conclusion

Save stands out as a reliable DeFi lending protocol on Solana, offering the Solana ecosystem the flexibility to earn passive income or borrow against their holdings without a strict repayment schedule for years. Following its rebranding from Solend and the introduction of the SAVE token, the lending platform continues to improve its governance and expand its cross-chain ecosystem.