What is Vectis?

Vectis is a dapp for advanced yield strategies, delta-neutral hedging, and the use of leverage when safe to generate returns for stablecoin and staking token holders. The Vectis protocol also works by limiting a depositor’s exposure to price volatility and other DeFi risks.

Some Terms used by Vectis and their Meanings

In this article, some technical trading terms that might be unfamiliar to some readers will be used many times. The following are some of these words and a note on what they mean:

Funding Rate

A small fee exchanged between traders to keep perpetual futures prices close to the spot market since the value of assets traded in the perps market is usually slightly higher or lower than their value in the spots market. If the perps price is above spot, longs pay shorts. If it’s below spot, shorts pay longs. Depending on your position, the funding rate can either cost you or earn you money over time.

Vault

A pool that automatically manages your assets to earn yield. Instead of sitting idle, your funds are put to work through strategies already defined for profit.

APR (Annual Percentage Rate)

The yearly rate of return you can expect from a position as a percentage. It helps you compare potential earnings across different vaults on Vectis and other protocols offering the same services.

Arbitrage

A trading approach that takes advantage of differences across markets. By buying low in one place and selling high in another. Doing this helps traders capture small and very low-risk opportunities for profit.

Strategy

Strategy: A predefined set of rules or methods that put your assets to work. For example, vaults on Vectis can lend, stake, or arbitrage to generate returns. These actions generate returns in time with different levels of risk.

Vaults & Strategies

This section explains the vaults, how they work and how Vectis mitigates the trading risks involved.

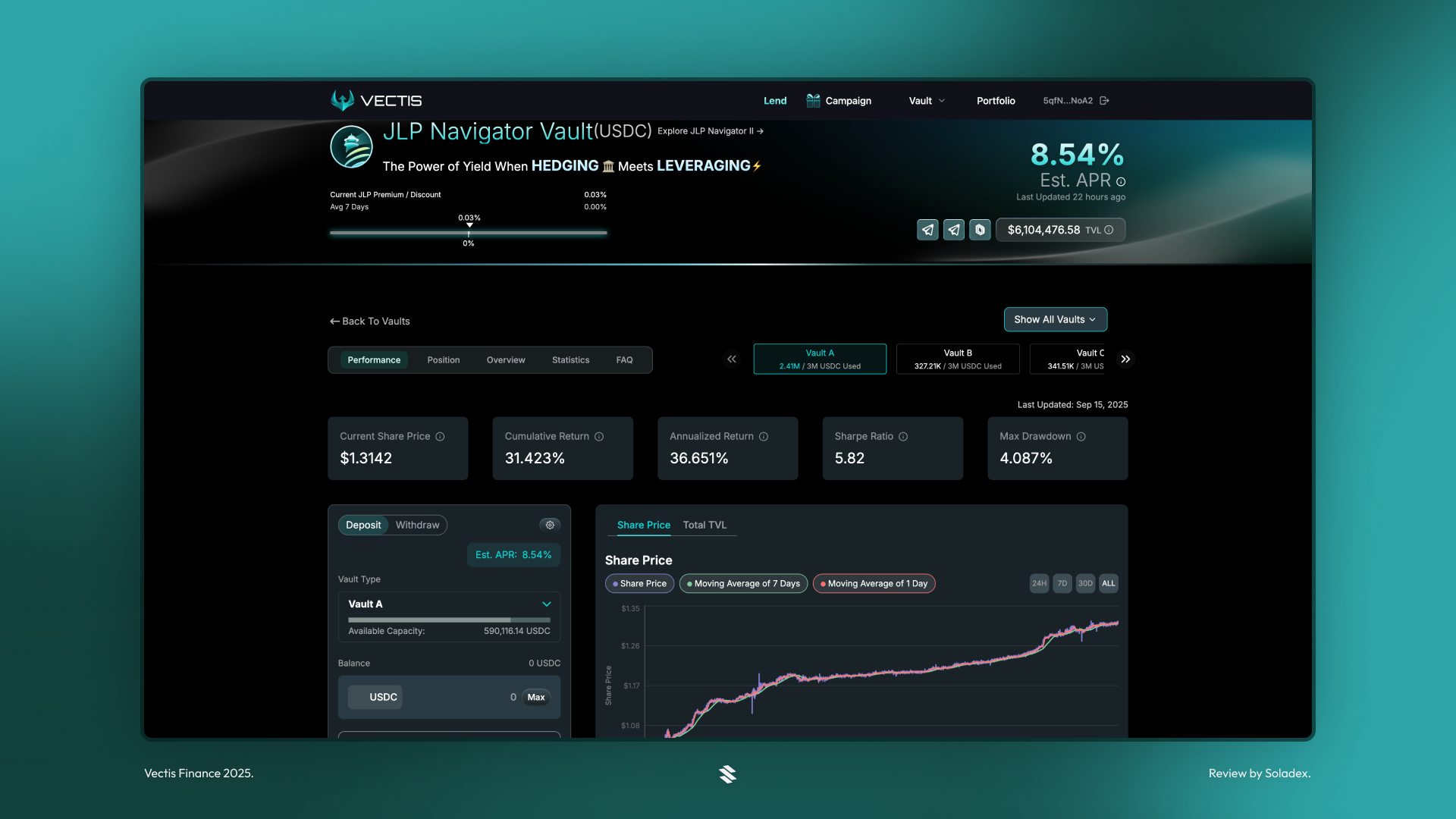

JLP Navigator (USDC)

The JLP Navigator USDC vault converts deposited USDC to Jupiter Liquidity Pool (JLP) positions. Vectis hedges out the price risk of the tokens in the index fund of JLP through short positions on exchanges such as Drift. The earnings from this vault is from the yields generated on the JLP rewards, funding rates coming from leveraged positions and trading fees earned. These earnings are returned to the pool to maximize profit for the depositors. The JLP Navigator vault is one of the most used vaults on Vectis.

JLP Navigator (II)

The JLP Navigator vault makes use of the JLP token as collateral to open short positions to serve as hedge because of the exposure to the tokens in the JLP index fund. The JLP Navigator vault was created to prioritize safety for the depositors. It comes with the Vectis Insurance Fund Protection that serves as a protection for users’ funds. If the losses of the vault exceeds 5%, the Insurance Fund is used to cover the deficit.

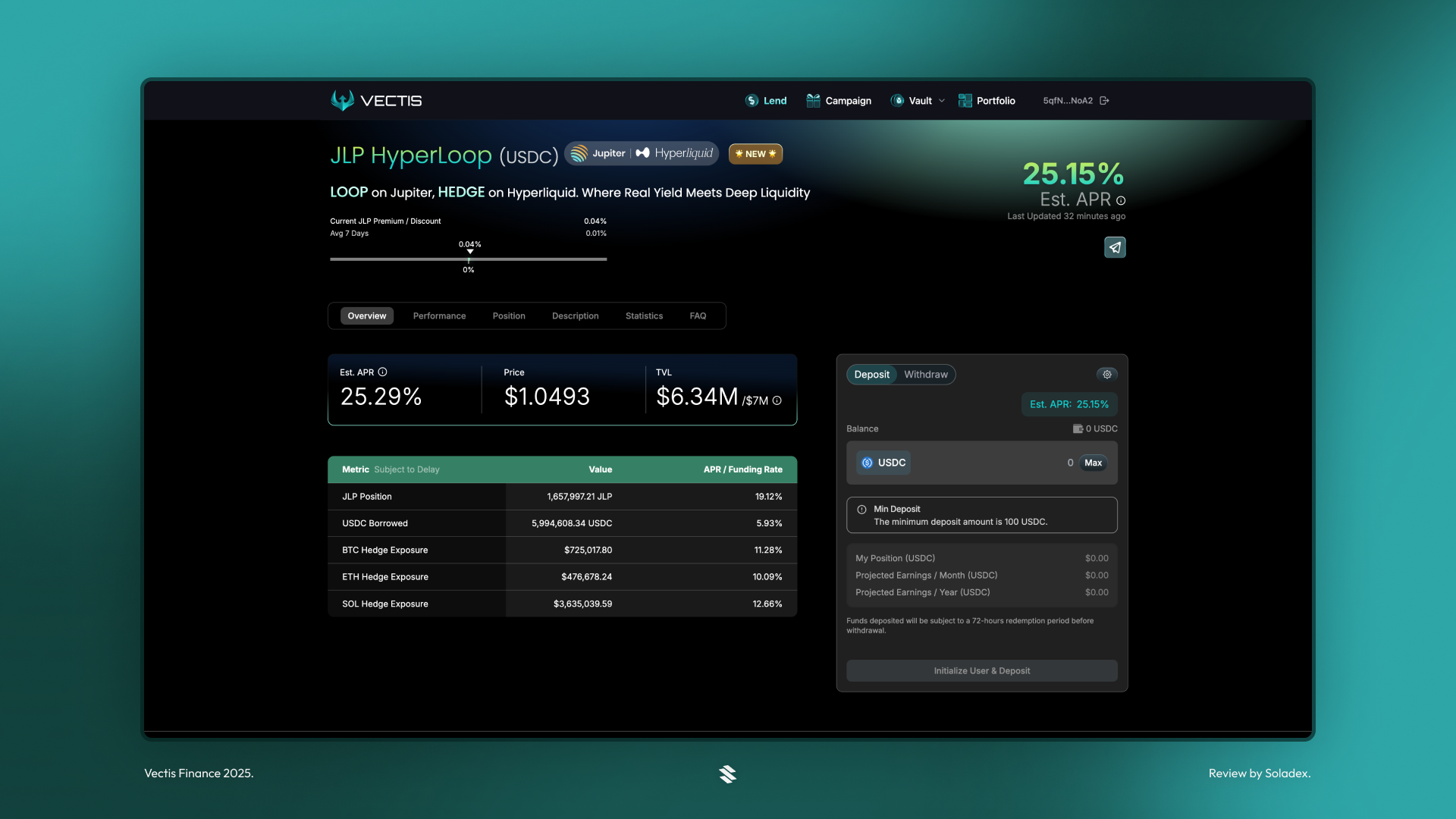

JLP Hyperloop

This strategy takes USDC deposits and puts them to work through a delta-neutral JLP setup that uses looping and hedging to balance risk and returns. The USDC is first converted into JLP and then looped with JLP Loans at lower borrowing costs than are found on margin platforms.

To reduce market risk, short positions are opened in SOL, ETH, and BTC on Hyperliquid for better funding rates, liquidity, and execution. The result of this strategy is a system that earns from JLP rewards, funding spreads, and fee rebates, while sharing those gains with depositors automatically.

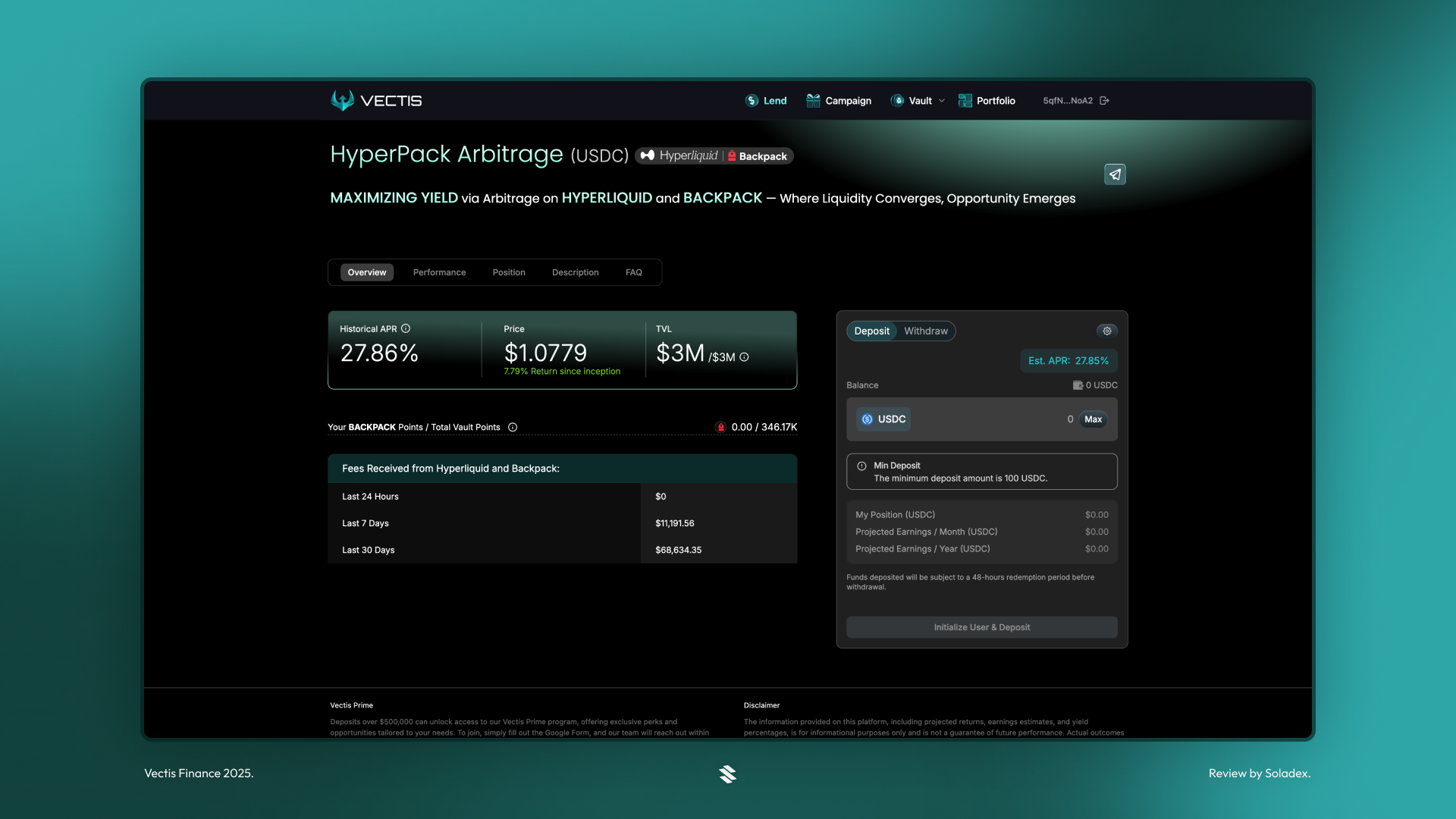

HyperPack Arbitrage (USDC)

This strategy is built to generate returns by arbitraging funding rate spreads across Hyperliquid and Backpack to keep positions delta-neutral. On top of that, Backpack’s airdrop and points program adds an extra layer of yield for depositors to receive from without extra effort. Primarily, yield is gained from funding differences and managed through Vectis’ automated rebalancing. Hyperliquid provides the deep liquidity, low slippage, and orderbook model necessary for this strategy to succeed.

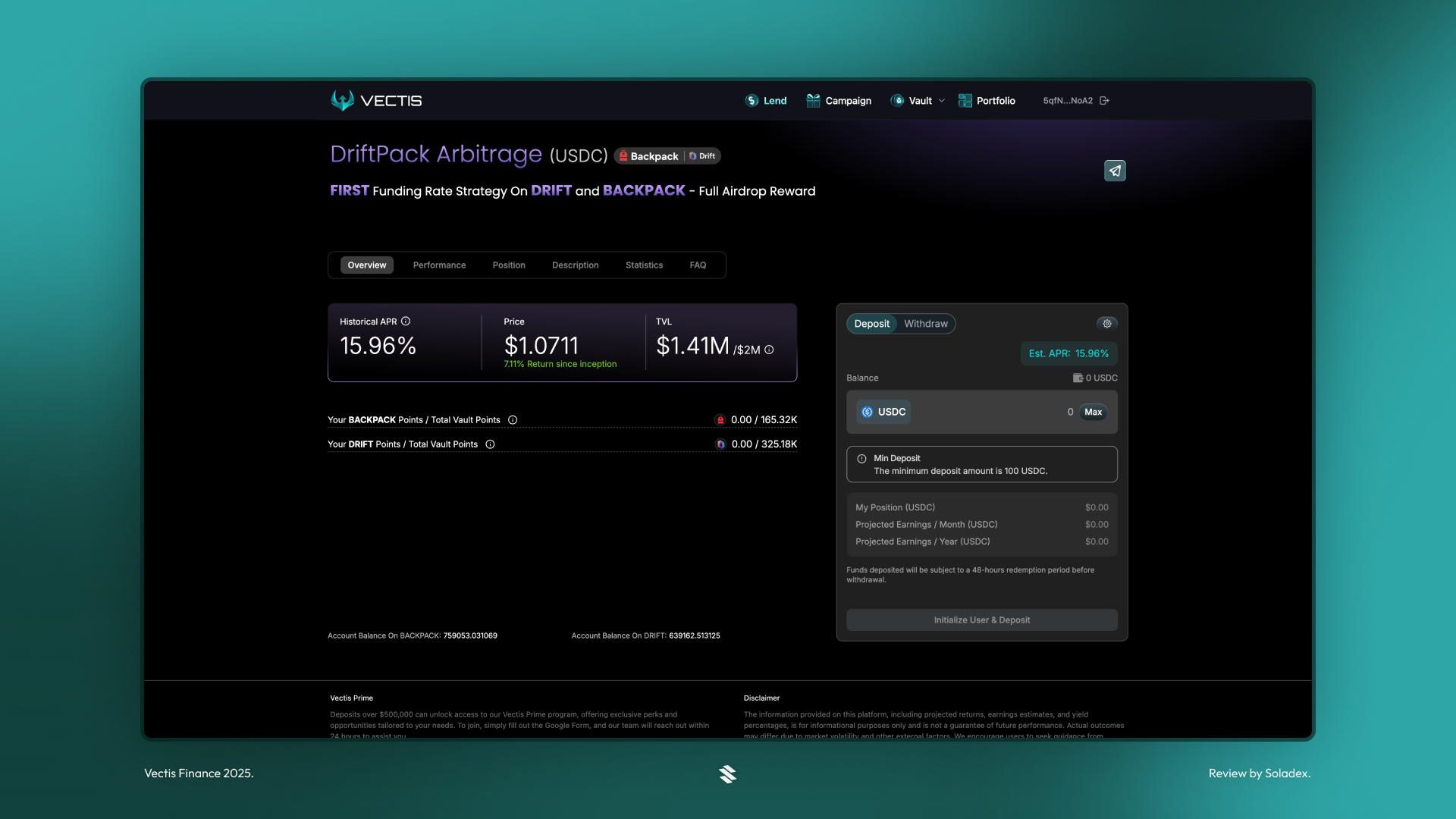

DriftPack Arbitrage (USDC)

Drift Arbitrage is the main funding rate strategy vault on Vectis. The vault generates yield for deposited funds by taking advantage of the difference in the funding rate on Drift and Backpack. The payment of the funding rates occur every 8 hours on either long or short trades while the strategy is automatically balanced by Vectis protocol.

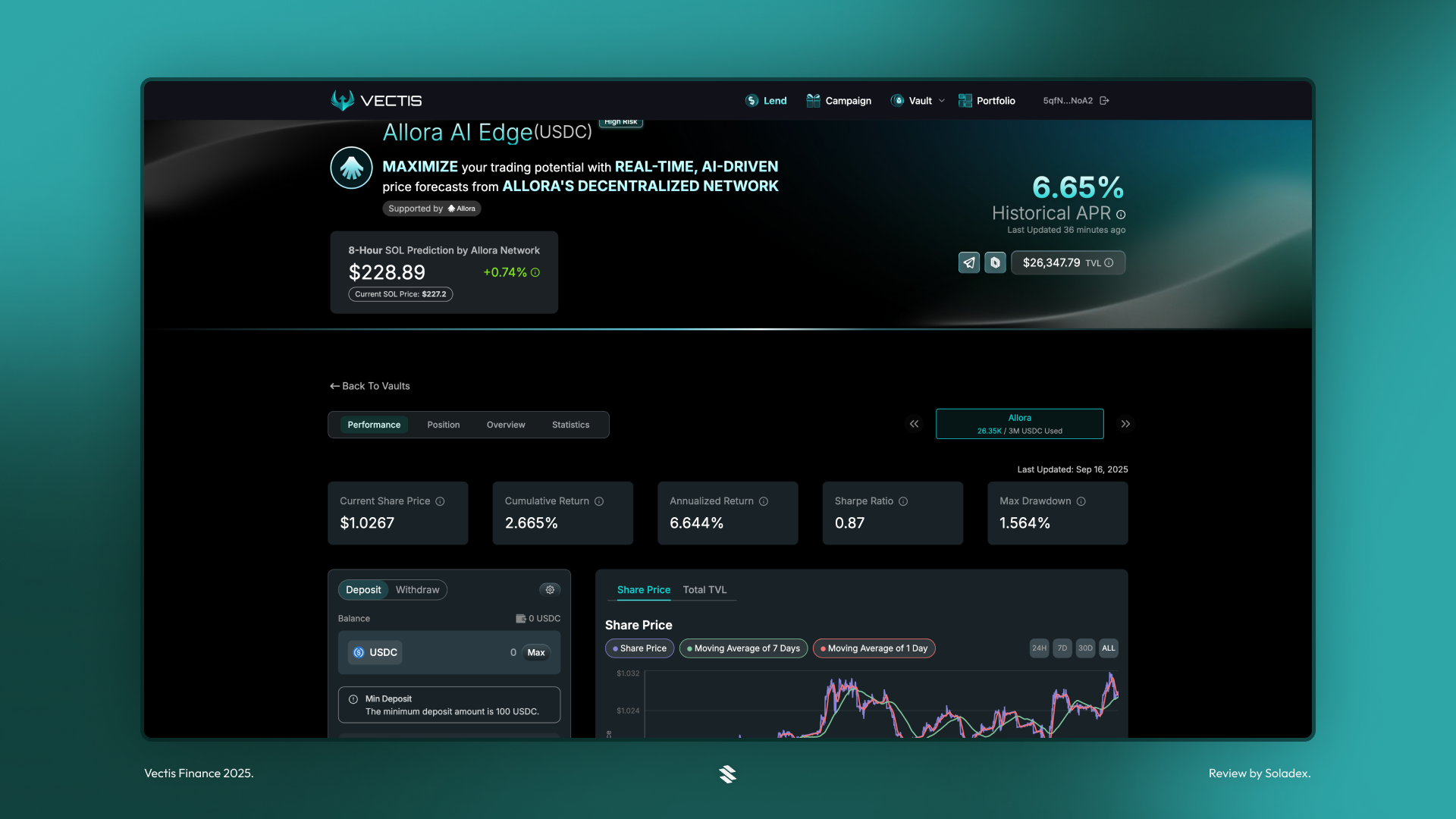

Allora AI Edge (USDC)

The Allora vault is a high risk vault with a low total volume locked. The strategy executes trading based on the price predictions provided by Allora network. Allora is a decentralized AI network that uses machine learning models to generate price forecasts. Because it is high risk and depositors are cautious, the total amount in the vault is low compared to other vaults.

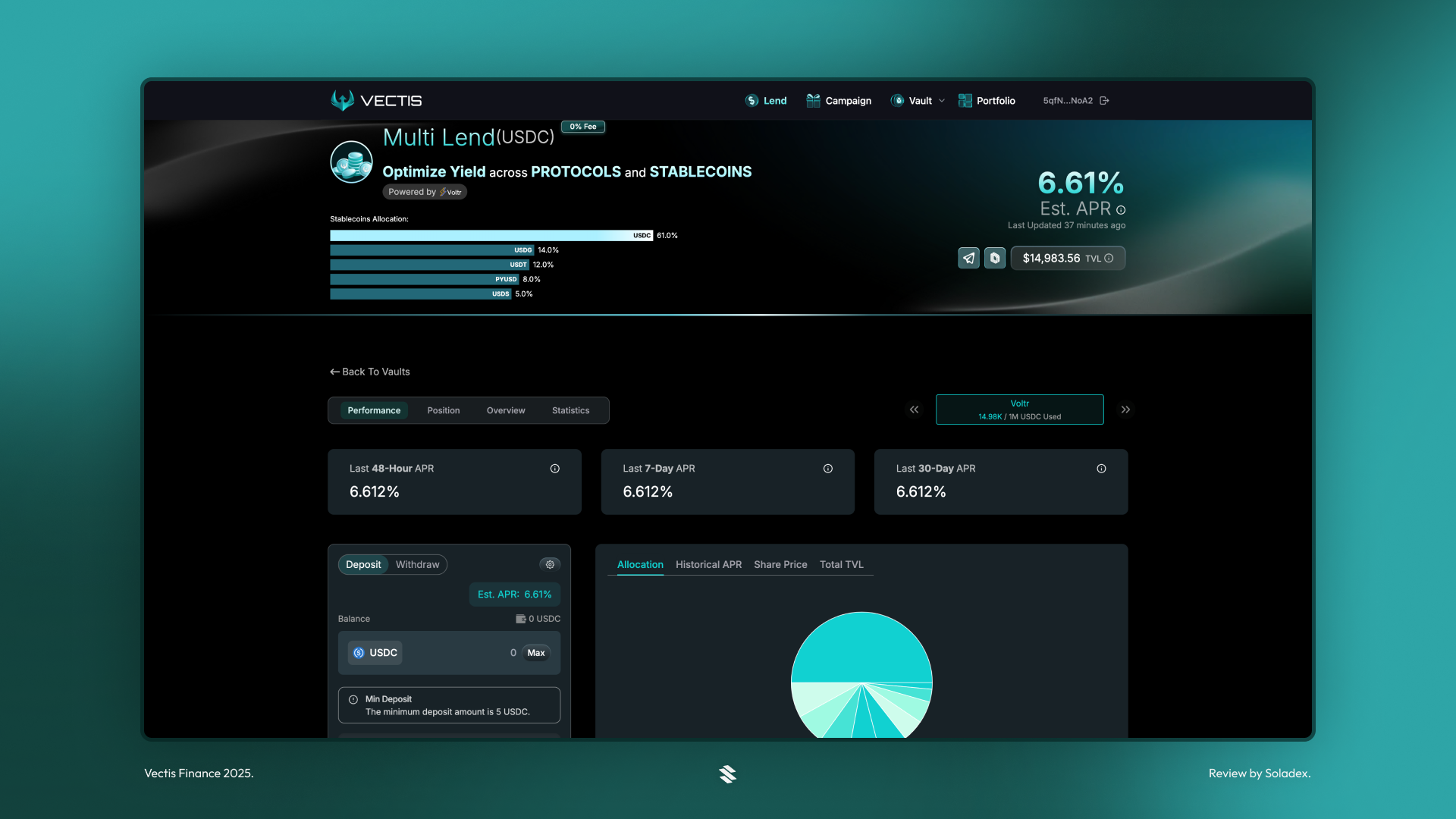

Multi Lend (USDC)

For depositors interested in a vault that is using a strictly lending strategy, Multi Lend is an option to be considered. The USDC asset deposited is split across multiple dapps such as Drift Spot, Kamino and Save main markets. Although there is a 0% fee on this strategy, the volume is low, just like the Allora AI Edge vault.

Vectis’ Performance

While writing this, the total value locked (TVL) for Vectis is around US$21-22 million on the Solana blockchain (based on the data from DeFiLlama). This is calculated as the sum of the spot holdings in the all the vaults on Vectis with realized profit and loss. For active traders who want to keep up with the rates and protocol development, the daily posts on the Vectis X account provide constant updates that keep you informed.

Conclusion

In less than a year, Vectis has built a strong set of vaults to serve the regular DeFi users’ needs. By reconciling higher yield and lower volatility in the various vaults available on the application, people can put their money to work instead of their assets sitting idle. It’s not risk-free, but for users who understand the trade-offs (up to smart contract risks), Vectis offers some of the more profitable strategies among other yield-bearing projects on Solana.