What is Flash Trade?

Flash Trade is a decentralised derivatives platform on the Solana blockchain that offers perpetual and spot contracts. Unlike many DeFi exchanges that focus on swaps or lending, Flash Trade enables users to trade leveraged positions in cryptocurrencies, forex, and commodities on the Solana blockchain with minimal cost and price impact.

How It Works

Traders connect their Solana wallet (such as Phantom) and select the asset they want to trade. Flash Trade uses a unique “pool-to-peer” liquidity model rather than a traditional order book, meaning your trade is matched against a shared liquidity pool. This enables near-zero slippage and fast fills. Leverage of up to 20x, sometimes touted as up to 100x, is available depending on the asset.

What are the Key Features of Flash Trade?

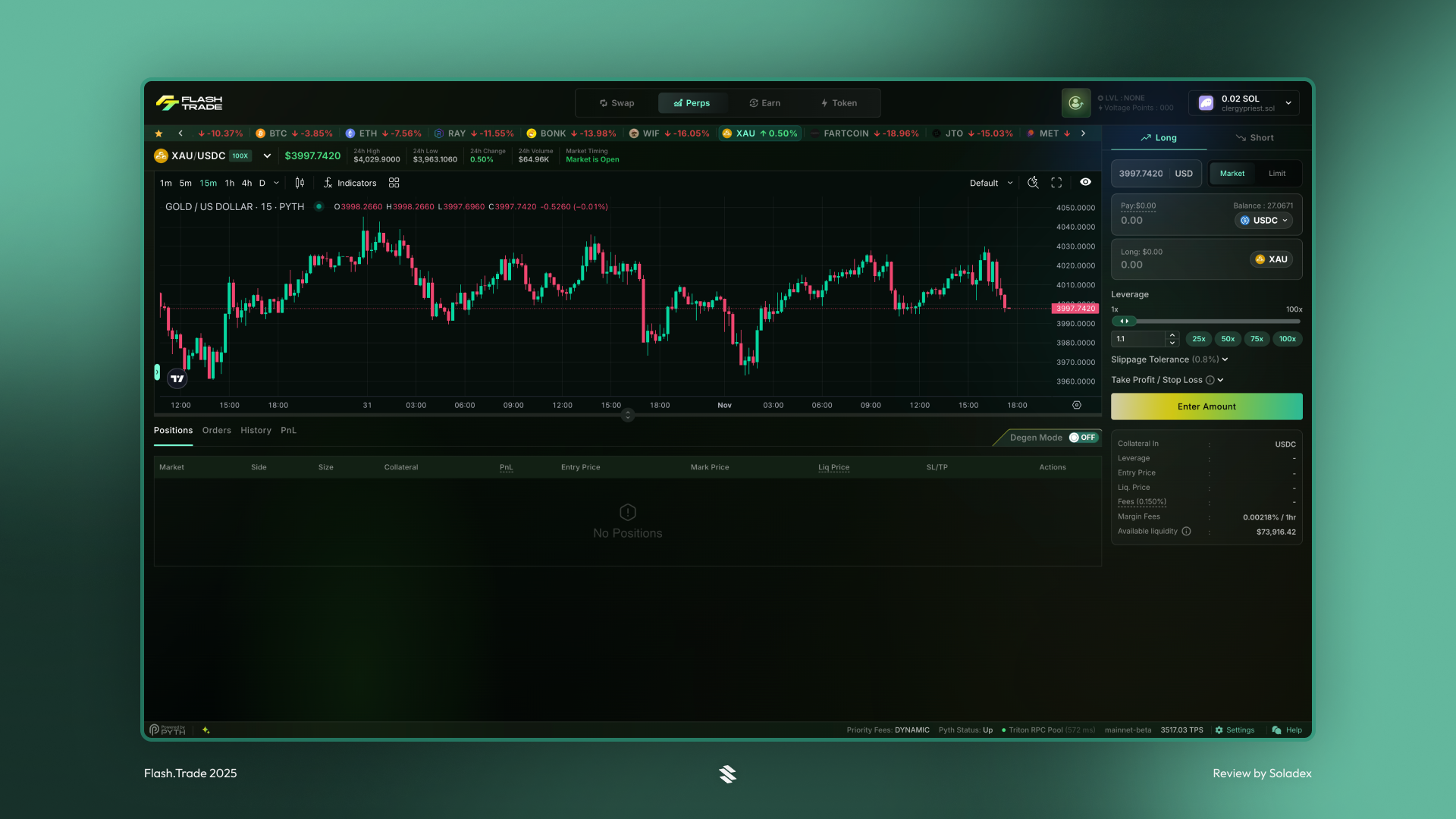

High Leverage Trading

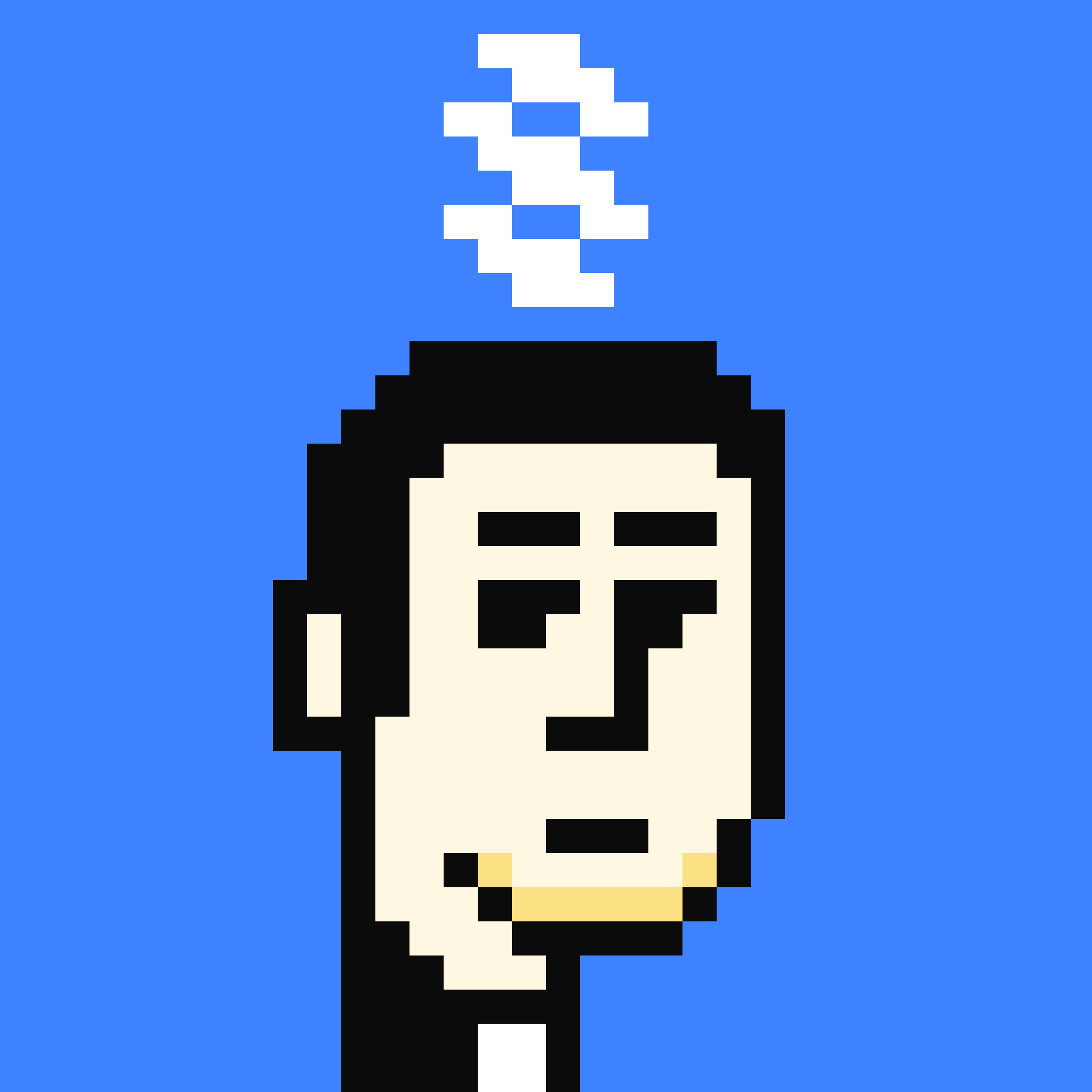

Flash Trade is a decentralized asset-backed perpetuals and spot exchange on Solana that offers up to 100x leverage on Solana-native derivatives contracts with low fees. The trading platform also supports advanced order types such as market, limit, stop-loss, and take-profit, which makes Flash more than a simple DEX. In the example below, I opened a small-sized trade using a 2x on a SOL long.

Pool-to-peer liquidity model

Instead of matching buyer to seller, liquidity is supplied to a pooled system. This approach by the Flash engineering team helps reduce slippage and provides instant fills. Trades on Flash draw on shared liquidity rather than traditional matching engines.

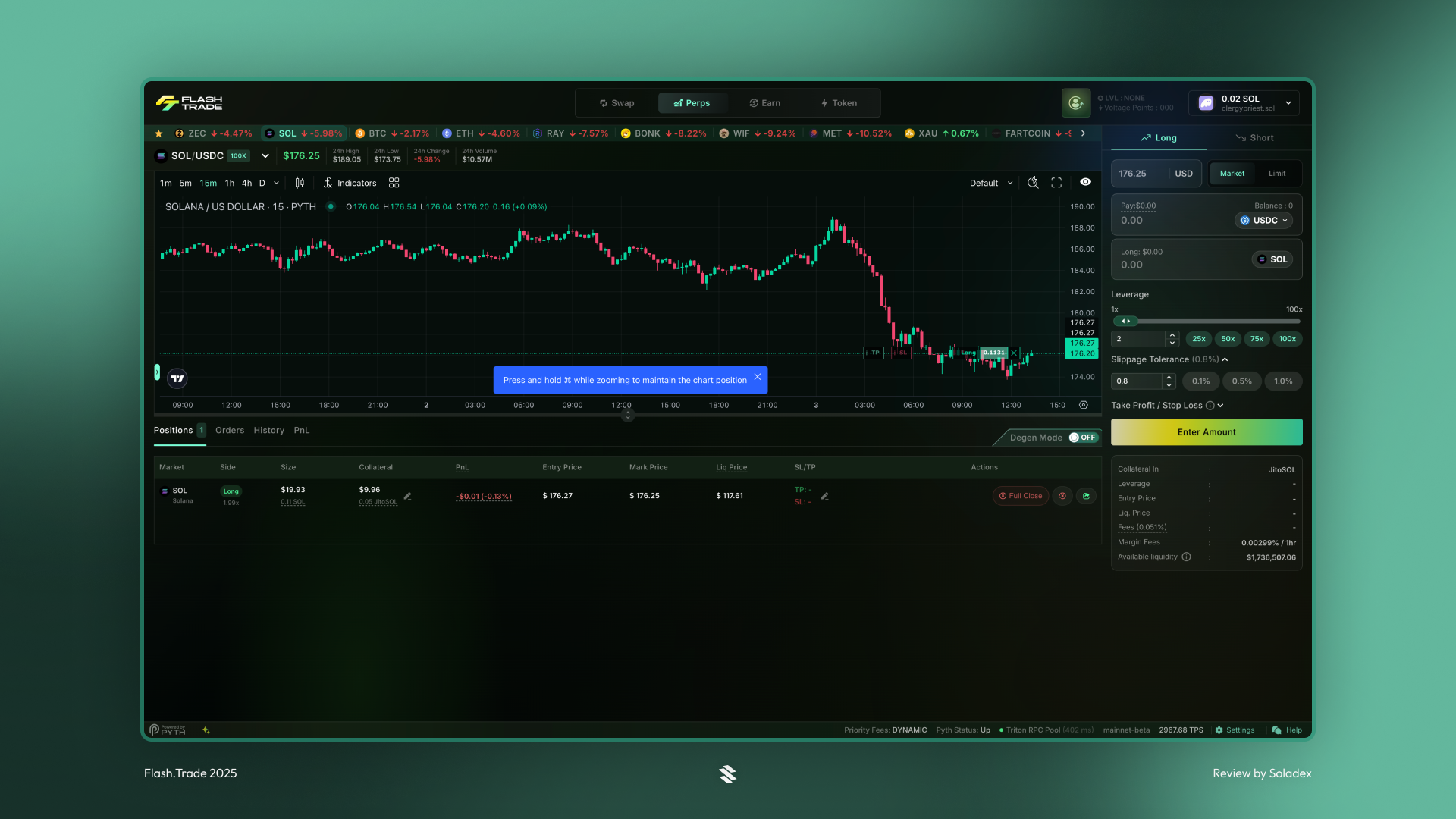

Multiple Assets

Flash supports major cryptocurrencies and altcoins on Solana, as well as exotic or cross-asset pairs in some cases. Cryptocurrency traders can also gain exposure to Gold on Flash.

Zero / minimal slippage

Flash is designed to minimize price impact (even for large trades) thanks to the liquidity pool architecture.

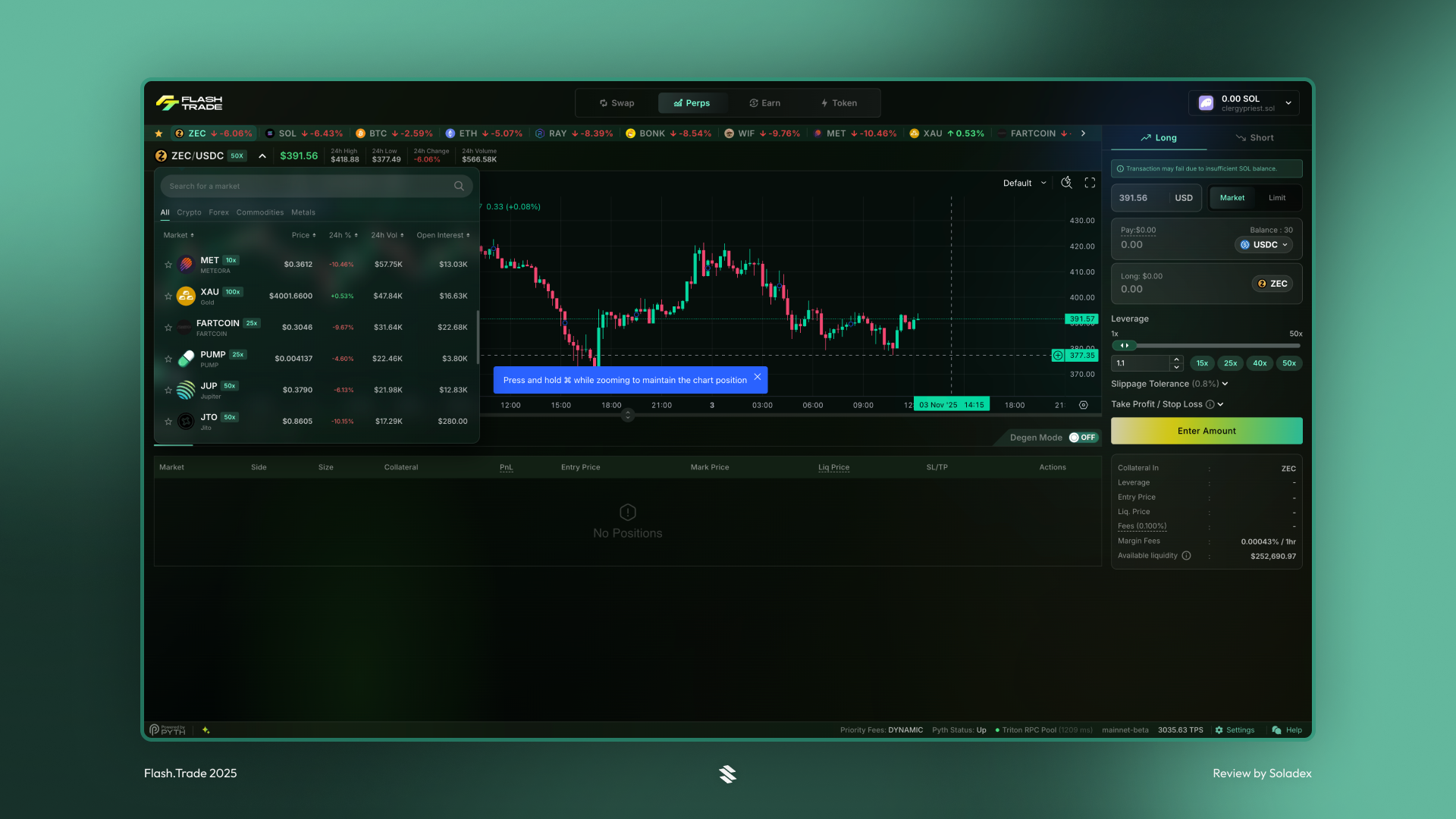

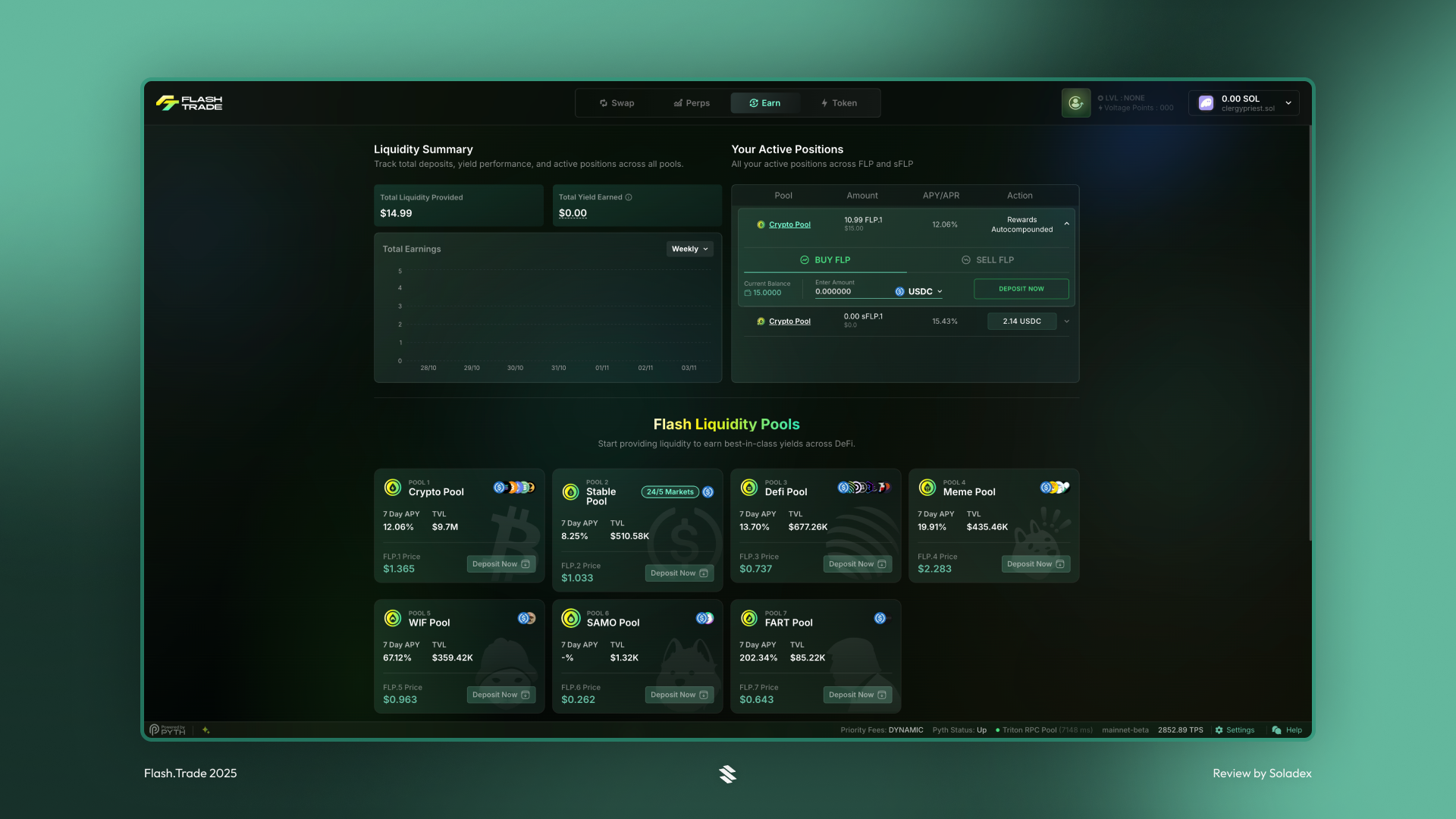

Yield on liquidity provision

Liquidity providers can stake into Flash’s pools and earn yield generated from trading fees. The initial liquidity was bootstrapped through the funding received from its NFT program called Flash Beasts, and its holders earned their mint fees plus extra over a period of time after the protocol launched. This NFT collection was later converted to FAF tokens in a migration.

Swapping on Flash Trade

To make token exchange easier for its users, Flash has a swap feature to that effect. With this feature, Flash’s FLP can also be swapped into or out of without going through another external decentralized exchange.

Trading Gold on Flash

Flash Trade isn’t just for crypto assets, as it also supports trading tokenized commodities like gold. This provides users with direct exposure to real-world assets directly onchain. By integrating gold markets into its application, Flash allows traders to speculate on gold prices and diversify their portfolio without relying on centralized exchanges.

FLP (Flash Liquidity Provider) Tokens

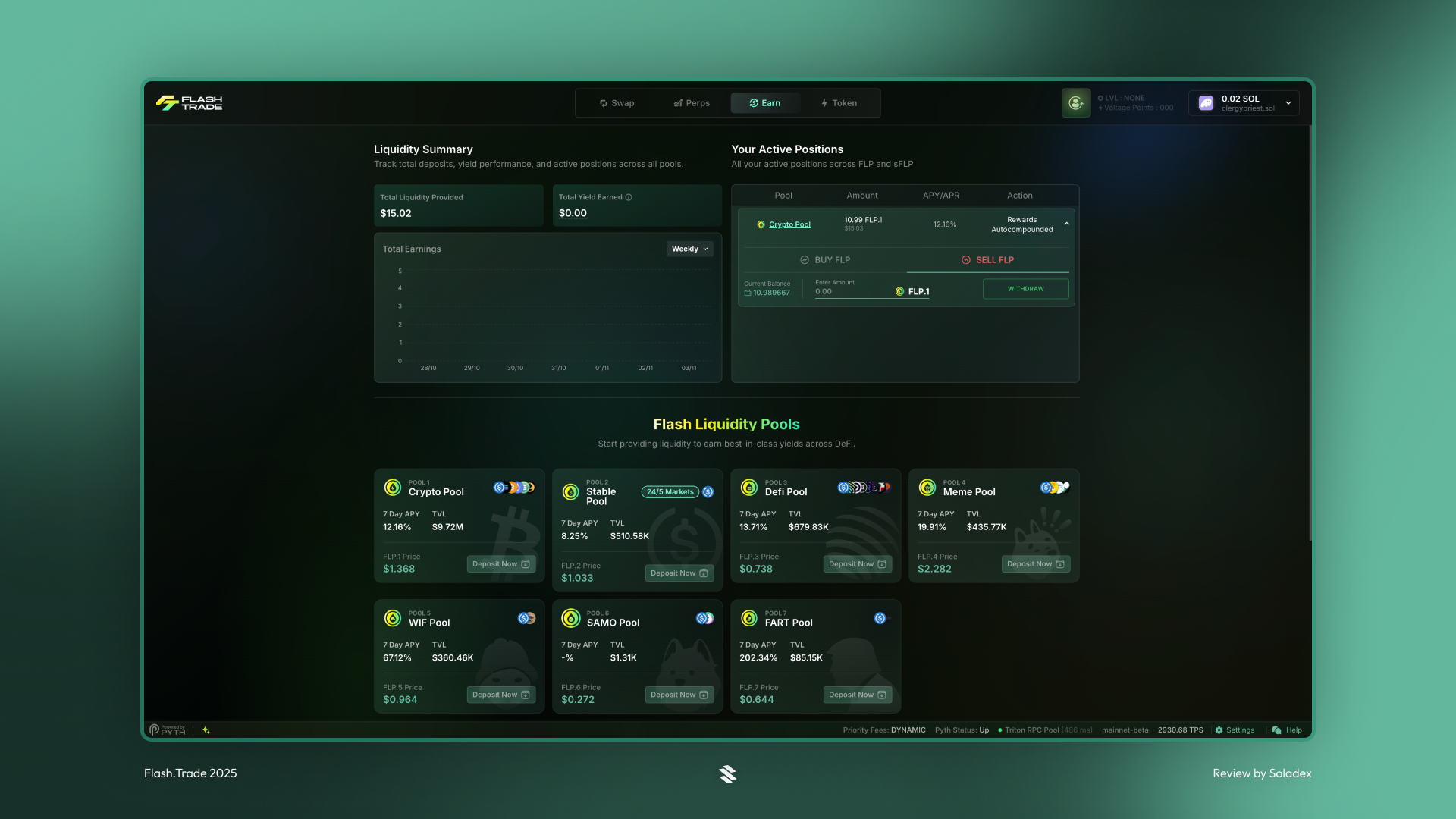

When users supply assets like BTC, SOL, ETH, JitoSOL, ZEC, or USDC to Flash, they receive FLP tokens in return. These tokens represent their share of the liquidity pool and automatically earn a portion of Flash’s trading fees and rewards. The more liquidity you provide, the more FLP you accumulate and the greater your earnings. Holding FLP tokens essentially means you are one of the market makers on Flash. Click on BUY FLP in the Earn section, as shown below, and deposit the token of your choice in the basket of assets used on Flash.

To withdraw FLP Position, click on SELL FLP and withdraw the deposited asset or use the Swap option to exchange FLP directly instead of withdrawing.

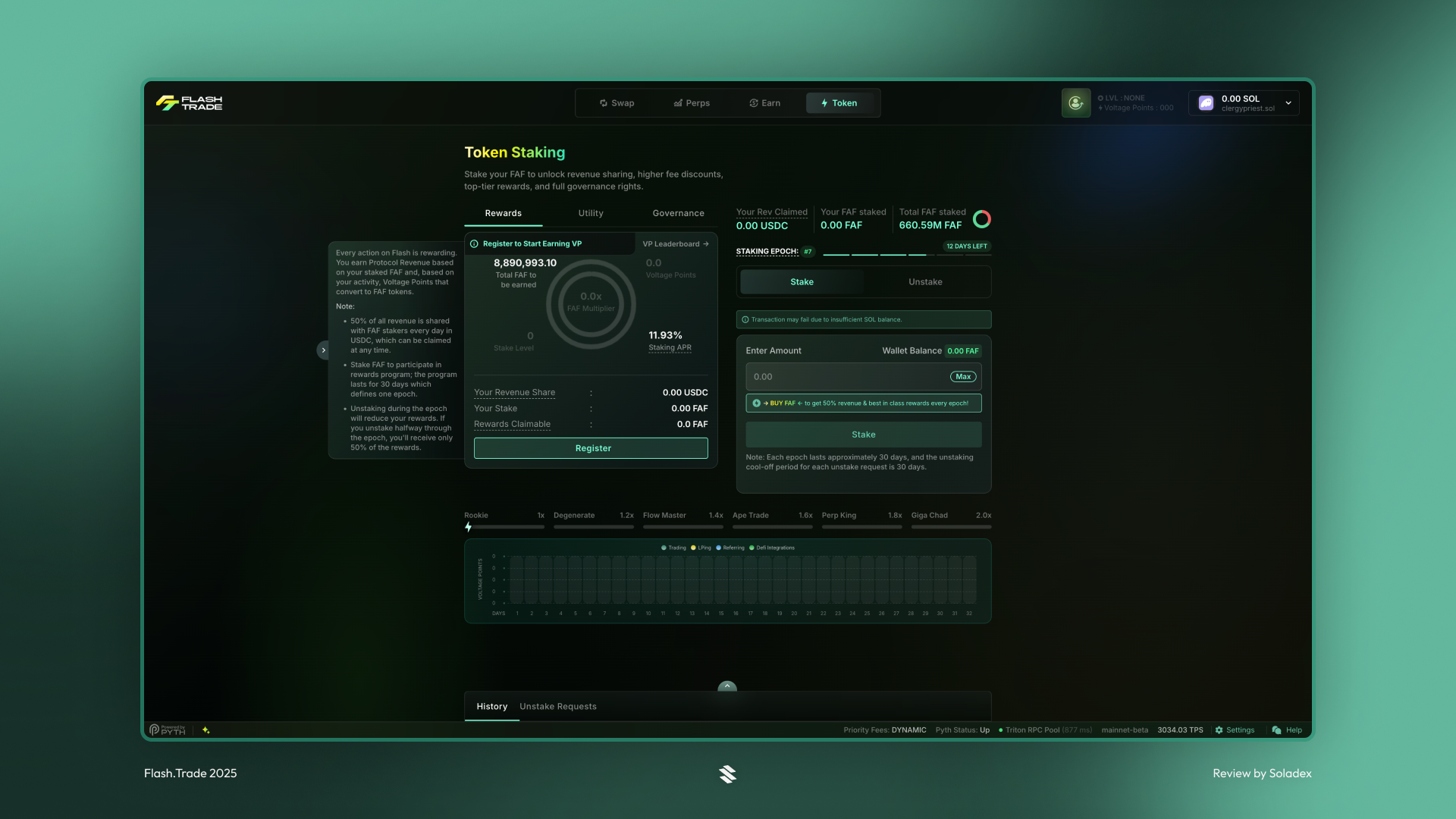

$FAF Token

The FAF token is the native asset of the Flash ecosystem. It governs how users earn and participate in the protocol’s decisions. Holders of the FAF token benefit from staking rewards, protocol revenue sharing, and governance rights over core parameters, including fees, leverage limits, and supported assets. This token was originally distributed to early supporters through the Flash Beasts NFT program.

Conclusion

Flash Trade is one of the most reliable derivatives platforms on Solana that brings most of the features of a centralized exchange such as high leverage, advanced orders, and deep liquidity, into a decentralized, non-custodial market. If you’re comfortable with the risks of leverage and want fast trading with minimal slippage, Flash is an exchange worth trying out. As with all derivatives, high rewards come with high risks.